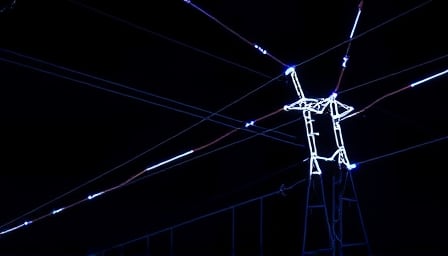

Evergy Inc Faces Crucial Q2 Earnings Report: Will It Meet Investor Expectations?

Evergy Inc’s Q2 earnings report is expected to be a critical test of the company’s financial health, with investors watching closely to see if it can deliver on promises of strong earnings growth.

2 minutes to read