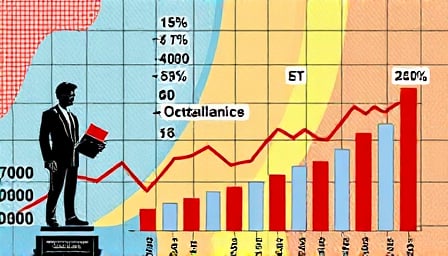

Verisk Analytics Earns RBC “Outperform” Rating: Strong Growth, AI & Climate Focus Drive Future Value

Verisk Analytics earns RBC’s “Outperform” rating as its 2023 revenue surges 20.8% and climate‑risk models grow, but investors should watch data‑privacy rules, debt levels and market concentration.

4 minutes to read