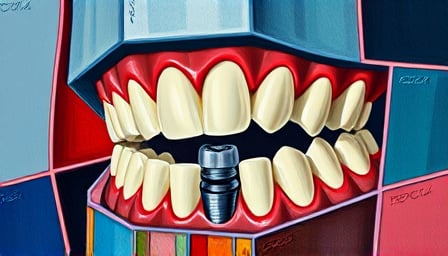

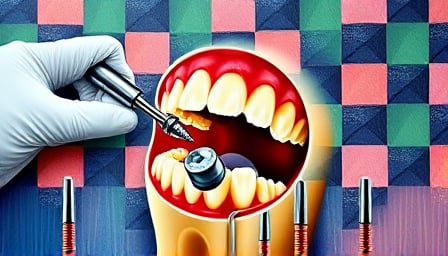

Straumann Holds Strong Position as Dental Implant Demand Grows, Backed by Robust Clinical Evidence

Explore how Straumann’s proven dental implants and bone grafts keep it strong amid flat Swiss markets—high survival rates, low peri‑implantitis, and solid regulatory backing.

3 minutes to read