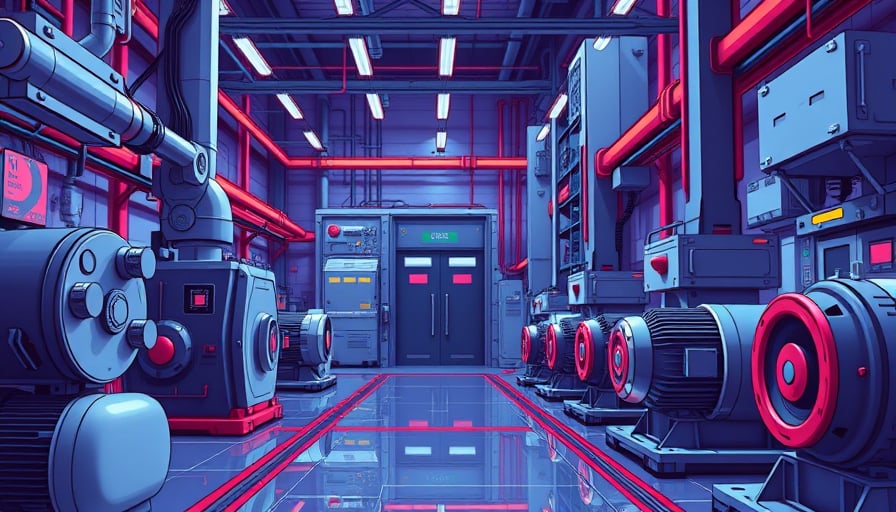

How Nidec’s 2026 Corporate Update Strengthens Market Position and Drives R&D Innovation

Discover how Nidec’s strategic review boosts motor innovation, cuts costs, and meets rising sustainability demands, securing shareholder value in 2026.

4 minutes to read