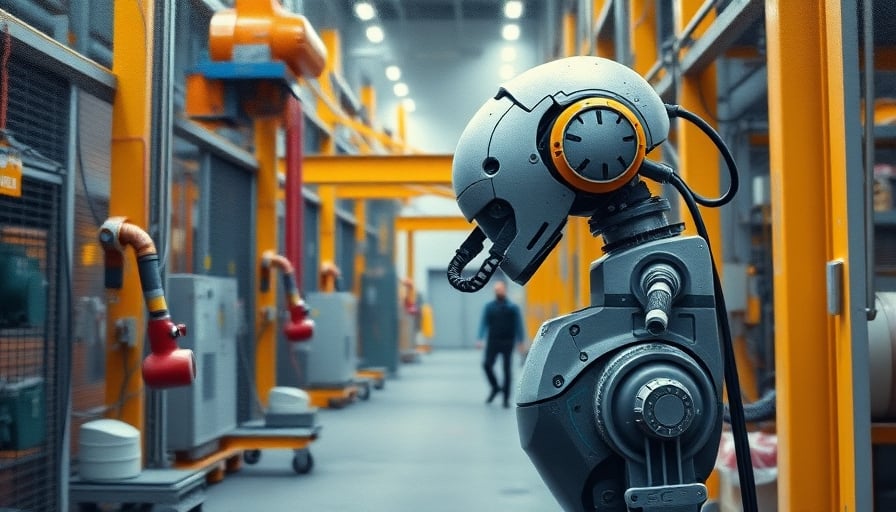

FANUC Corp. Faces AI‑Driven Shift: Strengths, Supply‑Chain Risks & Regulatory Hurdles

Discover FANUC Corp’s robust financials, AI integration challenges, and supply‑chain risks in our in‑depth factory‑automation analysis—insights for investors and industry leaders alike.

4 minutes to read