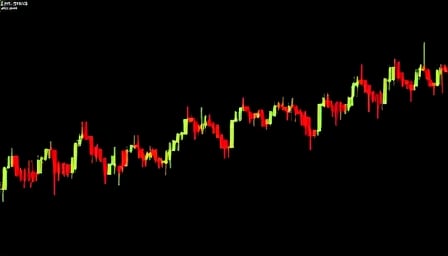

Dynatrace Faces Stock Decline Amid Cloud Intelligence Challenges and Strategic Investments

Dynatrace Inc.’s stock price has declined modestly due to intensifying competition, valuation pressures, and macro-economic headwinds, but the company’s continued investment in research and development and its focus on AI-augmented software intellig…

4 minutes to read