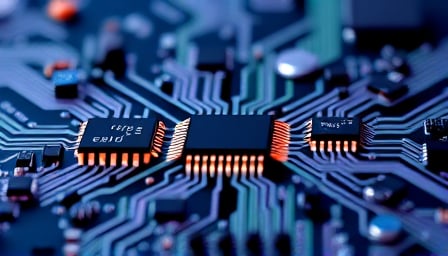

Broadcom’s AI‑Cloud Surge: Analyst Upgrade, Google Deal, $10B Buy‑In Fueling Growth

Broadcom’s AI‑chip push, Google partnership, and $10 billion institutional buy‑in signal a bullish future—yet supply‑chain risks, competition, and privacy concerns could temper gains.

5 minutes to read