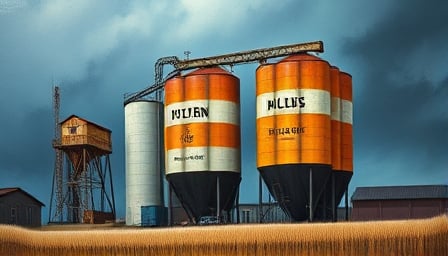

Archer-Daniels-Midland Seizes Growth Opportunities Amid Market Optimism and Lifestyle Shifts

Archer-Daniels-Midland Co. (ADM) is poised for sustained growth as it capitalizes on positive market sentiment, consumer trends, and strategic initiatives that align with the company’s diversified portfolio and commitment to sustainability.

4 minutes to read