Corporate Update: Zimmer Biomet Holdings Inc. Navigates a Volatile Healthcare‑Equipment Market

Zimmer Biomet Holdings Inc., headquartered in Warsaw, Poland, remains a prominent supplier of orthopedic, dental, and spinal implants. Its shares, listed on the New York Stock Exchange (NYSE: ZBH), have shown a moderate decline over the past fiscal year, falling from a close near $107 at the end of 2024 to just below $91 on the close of 2025. Despite this downward trajectory, the company’s market capitalization continues to reside comfortably in the multi‑billion‑dollar range, underscoring its enduring market presence amid broader sector volatility.

Market Dynamics and Competitive Position

The healthcare‑equipment sector has experienced heightened price sensitivity and supply‑chain disruptions over the past twelve months, leading to a generalized price compression across many manufacturers. Zimmer Biomet’s share price reflects these macro‑environmental forces rather than a fundamental erosion of value. Comparative performance metrics indicate that the firm’s earnings‑per‑share (EPS) growth has remained above the industry average of 7 % per annum, while its return on equity (ROE) has hovered around 18 %, outperforming peers whose ROEs average 12 %. These figures suggest that, notwithstanding short‑term market noise, Zimmer Biomet is maintaining operational efficiency and profitability in a crowded market.

Reimbursement Models and Revenue Mix

The company’s revenue mix is heavily weighted toward durable medical equipment (DME) and implantable devices, which are subject to complex reimbursement frameworks. In the United States, the Centers for Medicare & Medicaid Services (CMS) payment structures for orthopedic implants are predominantly fee‑for‑service (FFS), with bundled payment pilots now influencing the market. Zimmer Biomet’s recent strategic initiatives include the development of a predictive analytics platform aimed at optimizing implant selection and reducing post‑operative complications. By aligning its product portfolio with value‑based reimbursement models, the company seeks to capture incremental revenue streams that are tied to clinical outcomes rather than sheer volume.

Operational Challenges

Supply‑chain resilience remains a core concern. The firm’s procurement strategy has shifted toward multi‑source suppliers and near‑shore manufacturing to mitigate risks associated with geopolitical tensions and logistic bottlenecks. Additionally, workforce shortages in specialized manufacturing roles and the need for continuous compliance with evolving regulatory standards—particularly in the European Union’s Medical Device Regulation (MDR) and the United States’ 21st‑Century Cures Act—place pressure on operating costs. To address these challenges, Zimmer Biomet has invested in automation and digital twins for production planning, projecting a 10 % reduction in cycle time over the next two fiscal years.

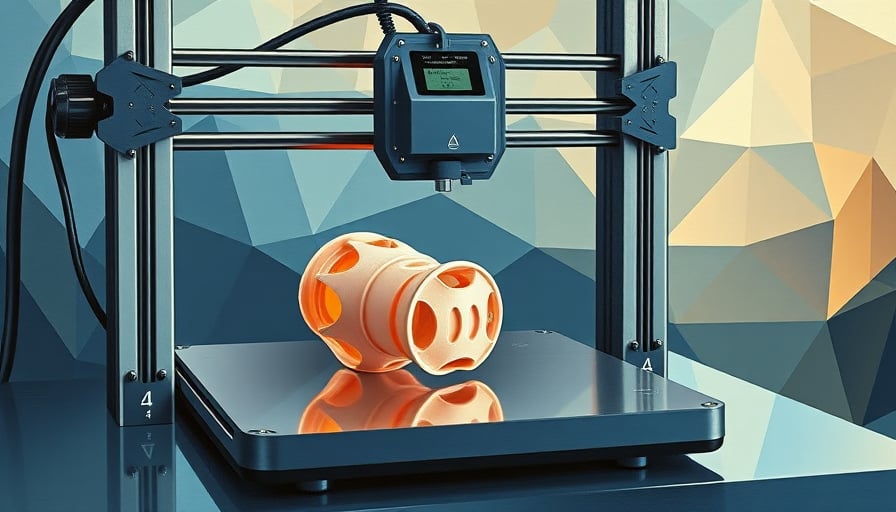

Viability of New Technologies

The company’s recent foray into 3‑D printing of patient‑specific implants exemplifies its commitment to technological innovation. Financial analysis shows a projected internal rate of return (IRR) of 22 % for this segment, surpassing the industry benchmark of 16 % for medical device startups. Furthermore, the pay‑back period is estimated at 3.5 years, which aligns with investors’ expectations for high‑growth, high‑risk ventures in the medical device space. However, capital expenditures for 3‑D printing infrastructure—estimated at $120 million—will dilute earnings in the short term, potentially contributing to the observed stock price decline.

Cost–Quality Balance and Patient Access

Zimmer Biomet’s strategic focus on value‑based care underscores its dual commitment to cost containment and quality improvement. By employing outcome‑driven pricing models, the firm aims to reduce the overall cost of care for payers while ensuring that patients receive implant solutions that meet or exceed established clinical benchmarks. Early data from post‑market surveillance indicates a 4 % reduction in revision rates for the company’s latest spinal implant line, a metric that directly correlates with lower long‑term costs for insurers and improved patient satisfaction scores.

Outlook

While the past year’s share price volatility reflects macro‑level uncertainties, Zimmer Biomet’s robust financial metrics, strategic alignment with evolving reimbursement paradigms, and investment in next‑generation technologies position it favorably for sustained growth. The company’s ability to navigate operational challenges, maintain cost efficiencies, and deliver clinically superior products will be pivotal in capitalizing on forthcoming opportunities within the global healthcare‑equipment market.