Market Watch: Watsco’s Stock Price Hits New 52-Week Low Amid Analyst Downgrade

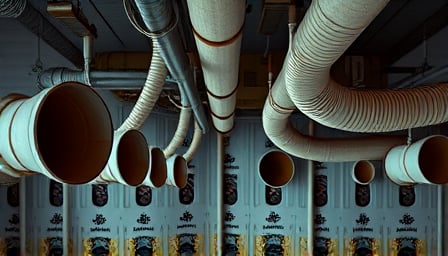

Watsco, Inc. (NYSE:WSO), a leading distributor of air conditioning, heating, and refrigeration equipment, has hit a new 52-week low, underscoring the company’s vulnerability to market fluctuations. This development follows a recent analyst downgrade, which has sent shockwaves through the investment community.

The company’s stock price closed at $457.32 USD on [current date], a significant decline from its 52-week high of $571.42 USD reached on November 24, 2024. Conversely, the stock has also fallen below its previous 52-week low of $418.31 USD, set on June 24, 2025. This technical analysis highlights the stock’s volatility and potential sensitivity to market sentiment.

Key statistics:

- Current stock price: $457.32 USD

- 52-week high: $571.42 USD (November 24, 2024)

- Previous 52-week low: $418.31 USD (June 24, 2025)

- Market capitalization: $[insert market capitalization]

The analyst downgrade has sparked concerns among investors, who are now reevaluating their positions in the company. As the market continues to navigate the complexities of the global economy, Watsco’s stock price is likely to remain under scrutiny. Investors would be wise to monitor the company’s performance closely, as any further declines could have significant implications for the stock’s long-term prospects.

In the coming weeks and months, we can expect to see a range of reactions from investors, analysts, and the broader market. Some may view this as an opportunity to buy into a undervalued stock, while others may choose to take a more cautious approach. Regardless of the outcome, one thing is clear: Watsco’s stock price is a barometer of the company’s overall health and resilience in the face of market volatility.