Verizon Communications Inc: A Leader in the Telecommunications Sector

Verizon Communications Inc has been a standout performer in the telecommunications industry, with its stock price exhibiting a moderate increase over the past few months. This upward trend is a testament to the company’s strong value proposition, which has been a key driver of its success. As a result, Verizon is widely regarded as a strong value stock, offering investors a compelling opportunity to capitalize on its growth potential.

Key Growth Drivers

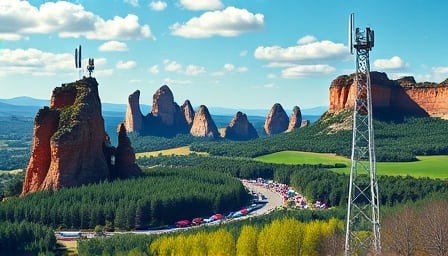

Verizon’s growing prowess in V2X (Vehicle-to-Everything) technology is expected to be a major catalyst for its future success. This innovative technology enables seamless communication between vehicles, infrastructure, and other road users, positioning Verizon at the forefront of a rapidly evolving market. By leveraging its expertise in this area, the company is well-positioned to maintain its competitive edge and drive long-term growth.

Stable Dividend Distribution

In addition to its strong growth prospects, Verizon has also maintained its stable quarterly dividend, with a substantial distribution of $11.2 billion in 2024. This commitment to shareholder returns reflects the company’s confidence in its financial performance and strategic positioning. By providing a reliable source of income, Verizon is able to attract and retain investors, further solidifying its position as a leader in the telecommunications sector.

Forward-Looking Outlook

Overall, Verizon’s financial performance and strategic positioning have been positive, with solid growth and tech advances contributing to its success. As the company continues to invest in innovative technologies and expand its offerings, investors can expect to see further growth and returns on investment. With its strong value proposition, growing V2X capabilities, and stable dividend distribution, Verizon Communications Inc is well-positioned to remain a leader in the telecommunications industry for years to come.