Corporate Update: VAT Group AG

Company Overview

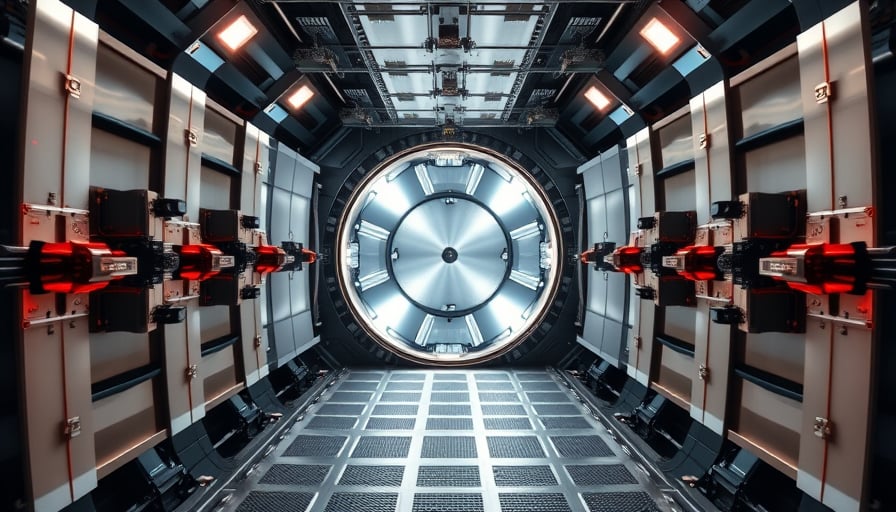

VAT Group AG, a publicly listed entity on the SIX Swiss Exchange, maintains its strategic emphasis on the development and manufacturing of vacuum valves and related components. These products serve critical roles in semiconductor fabrication, display manufacturing, and solar panel production. The firm’s portfolio is characterized by high‑precision engineering, robust quality standards, and a focus on supplying global manufacturers with reliable, high‑performance components.

Market Context

The industrial sector in which VAT Group operates is experiencing a moderate level of volatility, attributable to broader economic fluctuations, supply‑chain adjustments, and shifts in demand across technology‑driven subsectors. Recent trading activity in the Swiss market reflects this environment: share prices remain stable overall but display occasional swings typical of capital‑intensive industrial stocks. Investor sentiment is largely aligned with long‑term performance indicators rather than short‑term market noise.

Financial Performance and Corporate Actions

During the period under review, VAT Group AG did not announce any material corporate actions, including share buy‑backs, dividend changes, or significant capital‑raising initiatives. No earnings reports were released in the covered timeframe, leaving the company’s financial performance effectively unchanged from prior periods. This lack of new disclosures suggests a focus on maintaining operational consistency and preserving capital for future R&D investments.

Strategic Positioning

VAT Group’s commitment to high‑precision components positions it favorably within the semiconductor, display, and solar panel supply chains. Each of these sectors exhibits distinct growth drivers:

- Semiconductor: Demand continues to rise as 5G, artificial intelligence, and edge computing accelerate, requiring advanced vacuum systems for wafer fabrication.

- Display: Innovations in OLED and micro‑LED technologies necessitate precision valve components for thin‑film deposition processes.

- Solar: Expansion of photovoltaic manufacturing, especially in large‑scale production facilities, drives the need for reliable vacuum equipment to ensure high‑efficiency cell fabrication.

By concentrating on these interrelated high‑growth areas, VAT Group benefits from cross‑sector synergies while mitigating exposure to any single market’s cyclicality.

Broader Economic Trends

Several macro‑economic factors influence VAT Group’s operating environment:

- Technological Convergence: The overlap between semiconductor, display, and solar technologies amplifies demand for shared manufacturing infrastructure, enhancing the value proposition of component suppliers like VAT Group.

- Supply‑Chain Resilience: Global disruptions have highlighted the importance of robust, high‑precision manufacturing components, encouraging long‑term contracts and partnership stability.

- Sustainability Imperatives: Increasing regulatory pressure on energy efficiency and carbon footprint reduction drives growth in renewable energy production, directly benefiting the solar sector.

These trends reinforce the company’s long‑term strategy of delivering essential, high‑quality components to manufacturers across multiple technology domains.

Conclusion

VAT Group AG remains aligned with its core business objectives, providing high‑precision vacuum valves and related components to key sectors such as semiconductor, display, and solar panel production. The company’s stable share performance, absence of major corporate actions, and focus on long‑term supply‑chain relationships suggest a prudent, steady trajectory. Analysts and investors should continue to monitor the evolving demands within these interlinked sectors and the broader economic forces that shape them, as VAT Group’s success depends on sustaining innovation and reliability in a rapidly advancing industrial landscape.