Corporate News – Trane Technologies PLC

Trane Technologies PLC, the Irish‑based manufacturer of industrial and commercial HVAC equipment, disclosed a series of strategic initiatives and market developments in February 2026 that underscore its continued focus on expanding its thermal‑management portfolio and attracting institutional capital.

Acquisition of LiquidStack

Transaction Overview

In early February, Trane announced the intent to acquire LiquidStack, a Texas‑based specialist in liquid cooling solutions for data‑centre applications. The deal, slated for completion in the first quarter of 2026, is not yet priced publicly, but its strategic intent is clear: to embed LiquidStack’s advanced cooling architectures—such as direct‑to‑chip liquid loops and high‑density liquid‑cooling racks—into Trane’s Commercial HVAC (C‑HVAC) division. By doing so, Trane aims to offer an integrated thermal‑management ecosystem that spans conventional air‑based systems, high‑performance liquid cooling, and hybrid solutions tailored to the escalating power densities of modern data‑centres.

Technical Impact on Manufacturing

LiquidStack’s manufacturing footprint is heavily focused on precision machining of copper piping, injection moulding of heat‑exchanger plates, and robotic assembly of cold‑plate modules. Integrating these processes into Trane’s existing production lines will require substantial re‑tooling and supply‑chain adjustments. Trane’s engineering teams have already initiated a modular manufacturing approach, wherein liquid‑cooling components will be fabricated in dedicated “liquid‑cooling hubs” that feed into the broader HVAC assembly line. This modularity is expected to reduce lead times, enhance scalability, and improve yield rates across both product families.

Productivity Metrics

Post‑acquisition, Trane plans to track key productivity indicators, including:

- Cycle time reduction for end‑to‑end assembly of hybrid units (target: 15 % decrease).

- First‑pass yield for liquid‑cooling modules (target: 98 %).

- Manufacturing cost per unit for the new hybrid product line (target: 10 % below the industry average).

By leveraging LiquidStack’s high‑precision manufacturing and Trane’s established quality management system, the combined entity is positioned to deliver superior thermal efficiency while maintaining cost competitiveness.

Institutional Investor Activity

During the same week, Trane’s share price experienced modest institutional buying. A large‑cap equity fund acquired over two thousand shares, while a market‑beta ETF purchased a few hundred. Conversely, a senior insider divested a significant portfolio of Trane holdings. The net effect of these transactions, combined with the acquisition announcement, has supported a stable valuation trajectory, with the NYSE trading price hovering around $459 and exhibiting only marginal pre‑market decline.

Market Implications

The influx of institutional capital signals confidence in Trane’s long‑term growth prospects, particularly in high‑growth segments such as data‑centre cooling and sustainable HVAC solutions. Institutional buyers often demand rigorous return‑on‑investment (ROI) metrics, prompting Trane’s management to emphasize capital‑efficiency initiatives and technology roadmaps that align with prevailing ESG and energy‑efficiency mandates.

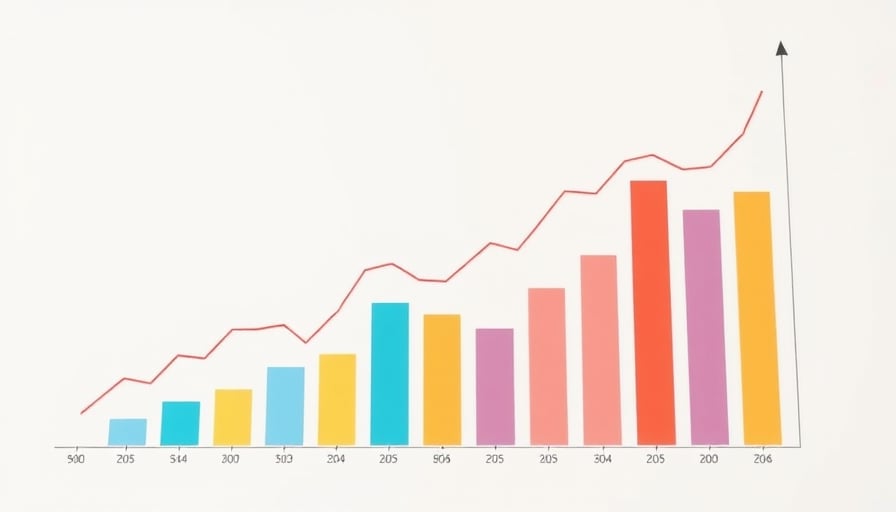

Capital Expenditure Trends

Trane’s planned acquisition and ongoing expansion projects reflect broader capital‑expenditure (CapEx) patterns within the heavy‑industry sector:

- Digitalization and automation: Investment in advanced robotics and AI‑driven predictive maintenance for HVAC production lines.

- Thermal‑management R&D: Allocation of $150 M toward liquid‑cooling research, focusing on copper‑free heat‑exchanger designs to reduce material costs and improve sustainability.

- Infrastructure upgrades: Expansion of manufacturing plants in Europe and North America to accommodate new product lines, with a projected CapEx of $200 M over the next five years.

These CapEx initiatives are influenced by macroeconomic factors such as commodity price volatility, supply‑chain disruptions, and the tightening of environmental regulations in the European Union and the United States.

Supply‑Chain and Regulatory Context

Supply‑Chain Dynamics

The integration of LiquidStack’s liquid‑cooling technology brings new dependencies on specialty alloys (e.g., high‑purity copper, titanium alloys) and precision components (e.g., micro‑valves, flexible tubing). Trane is already diversifying its supplier base to mitigate single‑source risks, while implementing vendor‑performance dashboards to monitor lead times, quality metrics, and geopolitical exposure. This proactive supply‑chain management is critical to sustaining the projected production ramp‑up for hybrid HVAC units.

Regulatory Landscape

Recent regulatory developments, including the EU’s Fit for 55 climate package and the U.S. Infrastructure Investment and Jobs Act, are reshaping capital‑investment priorities. Incentives for energy‑efficient infrastructure and data‑centre cooling solutions are creating a favorable environment for Trane’s expanded product portfolio. Compliance with the EU Energy Efficiency Directive will be a key factor in the design and certification of new liquid‑cooling modules, potentially opening additional markets in Europe.

Infrastructure Spending and Market Implications

The ongoing demand for data‑centres, coupled with the push for greener cooling solutions, is driving significant infrastructure spending worldwide. Trane’s strategic acquisition positions the company to capitalize on:

- Tier‑III and Tier‑IV data‑centre expansions that require high‑density cooling solutions.

- Edge‑computing facilities where compact, efficient liquid‑cooling units are preferred.

- Renewable‑powered data‑centres, where lower cooling loads translate into reduced carbon footprints.

By aligning its product development with these market trends, Trane aims to secure a larger share of the global thermal‑management market, translating into higher revenue per square meter of installed capacity.

Conclusion

Trane Technologies PLC’s February 2026 developments illustrate a concerted effort to enhance technological capabilities, strengthen supply‑chain resilience, and attract institutional capital—all within a macroeconomic context that favours sustainable, high‑efficiency industrial solutions. The acquisition of LiquidStack, coupled with disciplined CapEx planning and regulatory compliance, positions Trane to lead the evolving landscape of data‑centre thermal management and commercial HVAC solutions.