A Semiconductor Leader Takes Center Stage

Texas Instruments Inc, a stalwart in the world of semiconductor design and manufacturing, has caught the attention of analysts for its impressive fundamentals and pricing power. The company’s stock has been on a tear, reaching a recent high that’s left investors and analysts alike taking notice.

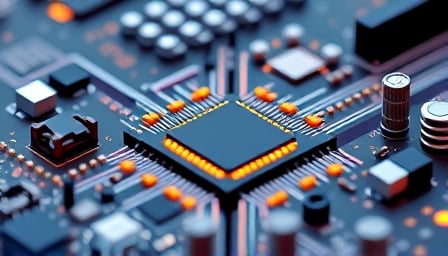

One of the key factors driving Texas Instruments’ success is its unwavering commitment to innovation. The company’s expertise in analog ICs and embedded processors has enabled it to stay ahead of the curve, delivering cutting-edge solutions that meet the evolving needs of its customers. This focus on innovation has not only helped the company maintain its market position but has also earned it a reputation as a leader in the industry.

Analysts have been quick to praise Texas Instruments’ strong fundamentals, citing its pricing power as a key driver of its success. The company’s ability to command a premium for its products has allowed it to maintain its margins, even in a competitive market. This, combined with its impressive innovation pipeline, has made Texas Instruments a standout pick among other companies.

As the company prepares to release its upcoming earnings report, investors will be closely watching to see how it performs. With its strong fundamentals and pricing power, Texas Instruments is well-positioned to deliver a solid report. Whether it’s the company’s continued innovation, its commitment to delivering high-quality products, or its ability to navigate the complexities of the semiconductor market, Texas Instruments is a company that’s worth keeping an eye on.

Key Takeaways:

- Texas Instruments’ strong fundamentals and pricing power have driven its stock to a recent high.

- The company’s commitment to innovation has enabled it to stay ahead of the curve in the semiconductor market.

- Analysts have praised Texas Instruments’ pricing power, citing it as a key driver of its success.

- The company’s upcoming earnings report is expected to be closely watched by investors.