Market Watch: Synchrony Financial Continues to Impress

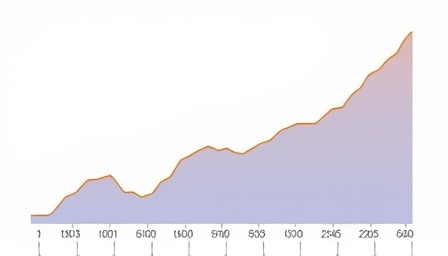

Synchrony Financial’s stock price has been on a tear over the past three years, with investors who took the plunge at the company’s listing on the New York Stock Exchange (NYSE) now reaping substantial rewards. A $1,000 investment in the company’s shares at the time of its IPO has grown to a staggering 34.977 shares, valued at a substantial amount.

Financial Performance on Full Display

The company’s financial performance has been nothing short of impressive, with its stock price reaching a 52-week high. This upward trend is a testament to Synchrony Financial’s solid financial footing, which has enabled the company to deliver strong results quarter after quarter.

Beneficial Ownership Changes: A Closer Look

Recent news of beneficial ownership changes in the company’s securities has been reported, but the details of these changes remain unclear. While this development may have sparked some concern among investors, it’s essential to note that the company’s overall financial performance has not been impacted. Synchrony Financial’s stock price continues to reflect the company’s solid financial performance, and investors remain optimistic about the company’s future prospects.

Key Takeaways

- Synchrony Financial’s stock price has increased significantly over the past three years

- Investors who invested $1,000 in the company’s shares at the time of its IPO now hold 34.977 shares

- The company’s financial performance has been strong, with a 52-week high in its stock price

- Beneficial ownership changes in the company’s securities have been reported, but the details remain unclear