Market Performance and Investor Sentiment

STMicroelectronics NV registered a modest uptick in its share price on Thursday, outpacing the broader market by a narrow margin. While the movement was slight, it reflected a sustained positive bias among investors, who appear to recognize the company’s resilience amid fluctuating commodity prices and geopolitical headwinds. The incremental rise suggests that market participants are reassessing the company’s value proposition in light of recent strategic initiatives and product launches.

Strategic Messaging at the Barclays Global Technology Conference

On the same week, STMicroelectronics’ President and Chief Financial Officer, Lorenzo Grandi, addressed the Barclays Global Technology Conference, delivering a concise overview of the firm’s priorities and financial outlook. Grandi emphasized a dual focus: deepening penetration in high‑growth sectors such as automotive and telecommunications while simultaneously reinforcing the company’s position in consumer electronics. He highlighted the company’s robust pipeline, citing key partnerships and upcoming product milestones that align with global trends toward electrification, 5G deployment, and the proliferation of connected devices.

Grandi’s presentation challenged the conventional wisdom that semiconductor firms must concentrate exclusively on core markets to achieve growth. Instead, he argued that a diversified portfolio—spanning automotive, telecom, consumer, and aerospace—offers a hedge against cyclical downturns and unlocks cross‑segment synergies. This perspective underscores STMicroelectronics’ commitment to a “portfolio‑centric” growth model that balances short‑term revenue stability with long‑term innovation investment.

Launch of Radiation‑Hardened Low‑Voltage Rectifiers for Low Earth Orbit

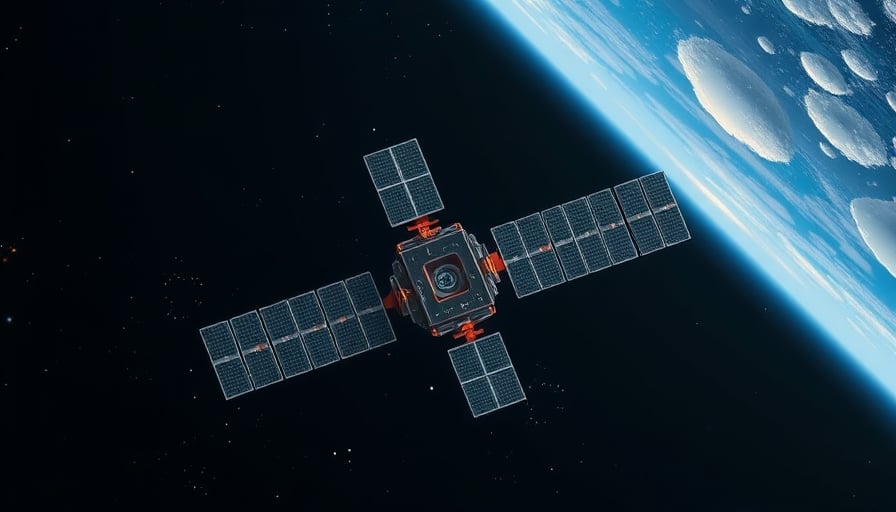

In a bold move that signals the company’s ambition to enter the burgeoning space‑technology arena, STMicroelectronics announced the launch of radiation‑hardened low‑voltage rectifier products tailored for Low Earth Orbit (LEO) applications. These components are engineered to withstand the harsh radiation environment of space while maintaining minimal power consumption—critical attributes for satellite payloads and inter‑satellite communication systems.

The product launch aligns with a broader industry shift toward miniaturization and energy efficiency in space electronics, driven by the rapid expansion of small satellite constellations and the growing demand for real‑time data analytics from orbit. By offering a solution that meets both stringent reliability standards and the low‑power requirements of modern LEO missions, STMicroelectronics positions itself as a key enabler in the next generation of space‑based services.

Patterns and Trends Across the Technology Landscape

Diversification as a Hedge – Companies that spread their revenue streams across multiple high‑growth domains are better insulated against sector‑specific downturns. STMicroelectronics’ simultaneous emphasis on automotive, telecom, consumer electronics, and space technologies exemplifies this trend.

Energy Efficiency Driving Innovation – Whether in automotive electric drive systems, 5G base stations, or spaceborne power modules, the push for lower power consumption continues to shape product development. The new radiation‑hardened rectifiers are a testament to the convergence of reliability and efficiency imperatives.

Strategic Communication Matters – High‑profile industry conferences remain pivotal for shaping investor perception. By articulating a cohesive strategic narrative, executives can reinforce confidence even when market conditions are uncertain.

Space as a Frontier for Semiconductor Growth – The commercialization of satellite constellations is opening a new revenue corridor for semiconductors. Firms that can deliver radiation‑hard, low‑power solutions are likely to capture significant market share in this nascent sector.

Strategic Implications for Stakeholders

- Investors should monitor STMicroelectronics’ progress in the space segment, as early entrants may reap substantial upside if the LEO market expands as projected.

- Supply‑chain partners must evaluate the potential for cross‑segment collaboration, particularly where automotive and telecom technologies can be leveraged for space applications.

- Competitors may need to revisit their portfolio strategies, balancing core market dominance with diversification into emerging high‑growth verticals.

Forward‑Looking Assessment

STMicroelectronics’ recent developments illustrate a deliberate strategy to anchor itself in proven markets while venturing into high‑potential niches. The company’s ability to synchronize product innovation with clear communication to investors suggests a maturity that could translate into sustainable long‑term growth. Should the LEO satellite industry accelerate, the firm’s early entry into radiation‑hardened power solutions could establish it as a preferred supplier, reinforcing its competitive moat across multiple technology domains.