Corporate News Report

STMicroelectronics NV is a multinational semiconductor company that has recently experienced a modest rise in its stock price. This movement occurred against the backdrop of a generally weak European market, which was affected by concerns regarding the U.S. labor market and potential global economic slowdown.

Market Context

- European equities were broadly subdued, reflecting uncertainty over U.S. employment data and macroeconomic prospects.

- Technology peers displayed varied performance, influencing sector sentiment and investor expectations for semiconductor firms.

STMicroelectronics’ Performance

- Shares of STMicroelectronics increased in value, diverging from the overall market trend.

- The price movement is attributed to a combination of stable market sentiment and the company’s strong fundamentals.

- Despite cautious investor behavior and hesitancy to commit significant capital, STMicroelectronics maintained a relatively stable position.

Factors Supporting Resilience

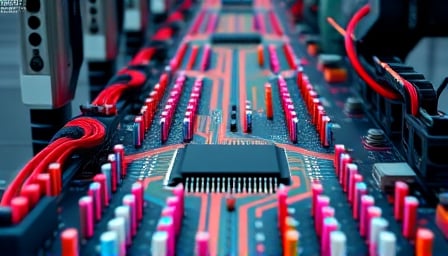

- Industry Position: The company’s role within the semiconductor supply chain provides a competitive advantage.

- Financial Strength: Consistent earnings, robust cash flow, and manageable debt levels support long‑term stability.

- Product Portfolio: Diversification across automotive, industrial, and consumer electronics segments mitigates concentration risk.

Outlook

While market volatility remains a concern, the recent moderate price increase suggests that STMicroelectronics NV is positioned to navigate short‑term uncertainties. Continued focus on product innovation and market expansion may sustain investor confidence and support future growth.