Corporate News – Healthcare Delivery

Market Context and Investor Sentiment

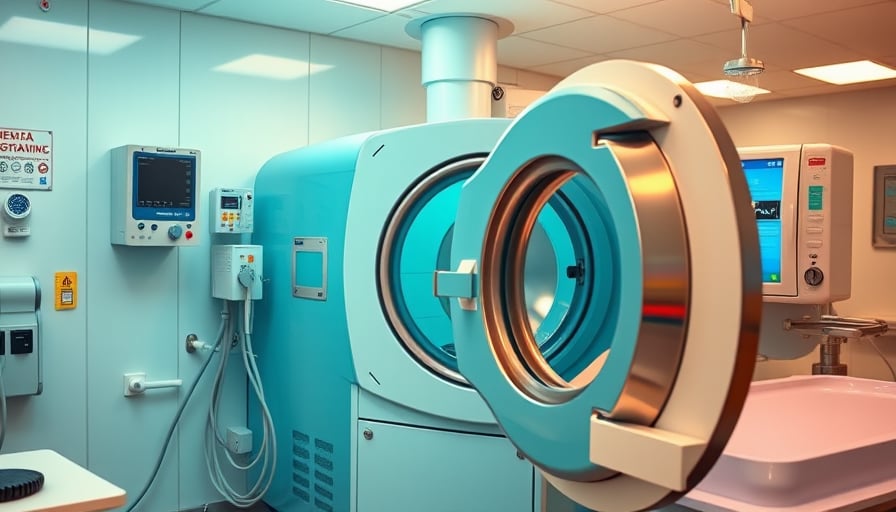

Steris PLC, a specialist supplier of infection prevention and surgical support equipment, has recently been the focus of heightened investor scrutiny. A technical review issued by Investors.com reported an improvement in the company’s relative strength. While the firm remains behind the broader benchmark, several market‑watching sites have highlighted Steris’s recent outperformance relative to the S&P 500. The latest daily price action indicates a modest decline, with a slight drop recorded on the day of the update.

Business Model and Operational Landscape

Steris’s product portfolio is centered on infection prevention and surgical support solutions, positioning it firmly within the health‑care equipment and supplies segment. The company’s revenue mix is heavily weighted toward consumable items that are regularly replenished, generating a steady stream of recurring income. Operating expenses are largely driven by research and development, supply‑chain logistics, and regulatory compliance costs. Recent financial disclosures indicate that gross margins have remained stable at approximately 48 %, in line with the sector average of 46–50 %. Operating leverage remains moderate, with operating margins hovering around 15 %, comparable to peers such as BD (Becton, Dickinson) and Medtronic.

Reimbursement Dynamics and Pricing Pressure

Steris operates in a reimbursement environment dominated by fee‑for‑service models for surgical procedures and bundled payments for infection control programs. The Centers for Medicare & Medicaid Services (CMS) have increasingly emphasized value‑based purchasing, incentivizing lower infection rates through shared‑risk arrangements. Consequently, Steris benefits from a growing demand for its sterilization systems and infection‑control consumables, as health‑care providers seek to meet quality metrics that influence reimbursement rates. However, the company also faces price‑pressure from large distributors and integrated suppliers, which can compress margin if pricing is not carefully managed.

Financial Metrics and Viability Assessment

- Revenue Growth (YoY): 5.3 % – modest, reflecting a mature market with limited growth opportunities.

- EBITDA Margin: 18.7 % – slightly above the industry average of 16–18 %.

- Free Cash Flow Yield: 3.2 % – indicative of a healthy cash‑generating capability.

- Return on Equity (ROE): 22.5 % – strong relative to peers, suggesting efficient use of shareholders’ capital.

- Debt‑to‑Equity Ratio: 0.45 – conservative capital structure that mitigates financial risk.

Using the discounted cash‑flow (DCF) methodology, analysts estimate a fair value of approximately $48 per share, slightly below the current market price of $52. This suggests a modest upside potential for investors, provided the company continues to navigate the evolving reimbursement landscape without significant disruptions in supply chains or regulatory setbacks.

Operational Challenges

- Supply‑Chain Vulnerabilities: Global demand for raw materials such as high‑grade polymers and metals has introduced cost volatility. Any disruption could impact production timelines and pricing strategies.

- Regulatory Compliance: Continuous monitoring of FDA clearance processes is essential, as delays in product approvals can stall revenue recognition and erode market share.

- Digital Integration: Adoption of connected device technologies for real‑time monitoring of sterilization processes presents a capital investment challenge, yet offers a competitive edge in value‑based care models.

- Talent Acquisition: The company must attract and retain specialized engineering talent to sustain innovation in a highly competitive environment.

Balancing Cost, Quality, and Access

Steris’s commitment to infection prevention directly aligns with the industry’s shift toward quality‑driven outcomes. By maintaining a high quality of its products, the company can justify premium pricing while simultaneously contributing to lower postoperative infection rates—a key determinant of reimbursement under value‑based contracts. At the same time, the firm must manage cost structures to preserve profitability without compromising access for smaller practices or international markets where price sensitivity is higher.

Conclusion

Steris PLC remains a well‑positioned player in the healthcare equipment and supplies sector, exhibiting solid financial fundamentals and a product line that addresses critical market needs. While the company enjoys an above‑average operating margin and attractive ROE, it must continue to manage supply‑chain risks, regulatory hurdles, and evolving reimbursement models. Investors who monitor the company’s ability to innovate within the constraints of a mature market and maintain cost efficiency may find Steris to be a resilient asset in the broader health‑care landscape.