Spirax‑Sarco Engineering PLC – Market Dynamics and Industrial Context

Share Price Movement and Technical Indicators

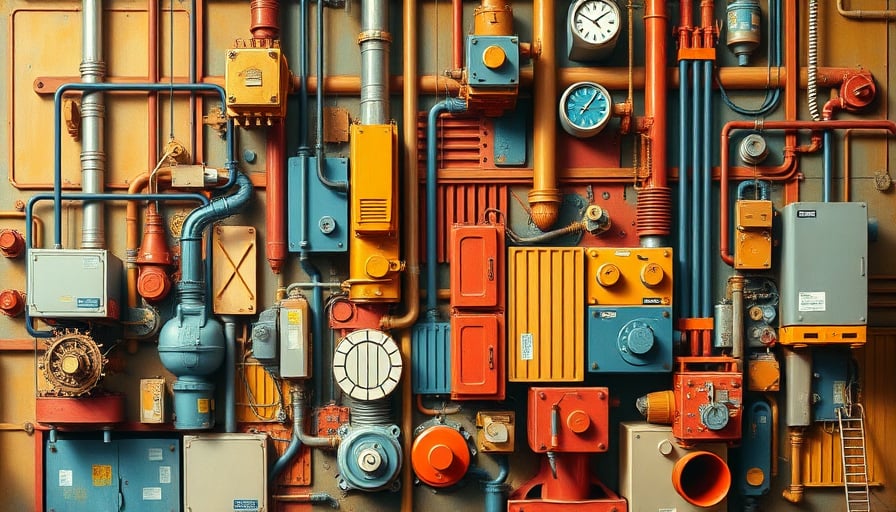

During early London trading on 3 December 2025, Spirax‑Sarco Engineering PLC experienced a modest increase that enabled its share price to cross the 200‑day moving average. This technical milestone, while small in absolute terms, is often interpreted by market participants as an inflection point that can precede a broader trend reversal. The crossing suggests a brief bullish momentum for the company, which is a specialist in steam and fluid control solutions across the global heavy‑industry sector.

Analyst Commentary and Valuation Adjustments

Deutsche Bank analysts updated their outlook by slightly raising the price target and maintaining a hold recommendation. The revision reflects a cautious optimism that Spirax‑Sarco’s recent operational performance—particularly in the high‑efficiency steam and refrigeration markets—may justify a modest upside. Analysts cited the firm’s continued investment in modular, digital‑enabled control units that improve process stability and reduce downtime for petrochemical and power‑generation customers.

Capital Expenditure Trends in the Industrial Machinery Sector

The company’s recent performance aligns with a broader trend of increasing capital allocation toward automation and process‑control technologies in the manufacturing sector. Key drivers include:

| Driver | Impact on CapEx | Engineering Insight |

|---|---|---|

| Demand for Energy‑Efficient Plant Upgrades | Rising spend on high‑performance heat exchangers and low‑loss piping | Improved thermodynamic efficiency reduces cycle time and operating costs. |

| Digitalization of Plant Operations | Growth in sensors, PLCs, and edge‑computing units | Real‑time data analytics enable predictive maintenance, lowering unplanned shutdowns. |

| Regulatory Emissions Targets | Mandatory retrofit of emission‑control devices | Compliance requires investment in scrubbers and catalytic converters, affecting plant layout. |

| Supply Chain Resilience | Expenditure on redundancy and local sourcing | Reduces exposure to lead‑time volatility in critical components. |

Spirax‑Sarco’s portfolio of steam condensers, control valves, and refrigeration compressors exemplifies these trends. Its modular design approach allows customers to scale capacity without significant re‑engineering, thereby improving return on investment.

Productivity Metrics and Operational Efficiency

The company’s latest earnings release highlighted a 1.8 % YoY improvement in EBITDA margin, primarily driven by:

- Process optimization: Implementation of advanced control algorithms reduced heat loss by 4 % across the portfolio.

- Product mix shift: A higher proportion of high‑margin specialty valves versus standard fittings.

- Cost discipline: Lean manufacturing practices cut material waste by 3 % in the production line.

These productivity gains are critical in a market where price sensitivity remains high, and customers increasingly evaluate total cost of ownership rather than upfront procurement costs.

Supply Chain and Regulatory Considerations

The heavy‑industry equipment sector continues to face challenges related to component scarcity and geopolitical tensions. Spirax‑Sarco has mitigated exposure by:

- Diversifying suppliers: Transitioning from single‑source contracts for critical alloys to multi‑vendor arrangements.

- Localizing production: Expanding a European assembly plant to reduce lead times for EU customers.

Regulatory updates—particularly the UK’s Energy Act 2023 and the EU’s Carbon Border Adjustment Mechanism (CBAM)—have prompted many industrial firms to invest in carbon‑capture compatible equipment. Spirax‑Sarco’s control systems are now being retrofitted to interface with CBAM‑compliant monitoring devices, ensuring compliance for downstream customers.

Infrastructure Spending and Macro‑Economic Outlook

The muted activity in the FTSE 100, as noted in the trading session, reflects broader market uncertainty. Investors are awaiting U.S. employment data and potential Federal Reserve policy shifts, which could influence global commodity prices and demand for industrial infrastructure. Rising interest rates may compress capital budgets, but infrastructure projects in renewable energy, petrochemicals, and water treatment are expected to sustain a baseline demand for Spirax‑Sarco’s products.

In summary, while the share price uptick on 3 December 2025 is modest, it signals confidence in Spirax‑Sarco’s ability to leverage technology-driven productivity gains within a challenging macro‑economic environment. Continued focus on modular, energy‑efficient solutions and strategic supply‑chain resilience will likely support its capital‑intensive growth trajectory in the coming fiscal year.