Spirax‑Sarco Engineering PLC – Market and Investment Overview

The London‑listed Spirax‑Sarco Engineering PLC recorded a modest decline in its share price during the opening session of 6 February 2026. The fall brought the stock slightly below the level recorded the previous trading day and was largely in line with broader market pressure on industrial and technology equities. Investors were reacting to a confluence of earnings announcements and heightened sensitivity to artificial‑intelligence (AI) disruption in data‑centric sectors.

Market Context

- Sector Performance: The FTSE 100 index slipped during the same session, reflecting a broader downturn in industrial and technology shares. Defensive and energy‑related equities, however, offered some support, mitigating the extent of the decline for sectors tied to traditional manufacturing and infrastructure.

- European Market: The European equity markets registered modest gains over the week, and Spirax‑Sarco’s share price movements remained largely in line with the general industrial sector performance, underscoring its position as a bell‑wether for engineering‑service providers.

Historical Investment Perspective

A retrospective review conducted earlier in the month examined the performance of an investment in Spirax‑Sarco made five years prior. The analysis, based on historical pricing data, indicated that the investment would have declined by approximately one third by the current date. Importantly, the calculation did not incorporate the effects of potential share‑splits or dividends, which could materially affect total return metrics.

This historical perspective highlights the volatility inherent in the engineering services sector, especially in the context of rapid technological change and shifting capital allocation patterns.

Corporate Disclosures

Spirax‑Sarco’s latest corporate disclosures were limited in scope:

- Shareholding Structure: A brief note disclosed the current distribution of equity ownership but did not elaborate on the strategic implications of shareholder composition.

- Operational/Financial Commentary: No substantive updates were provided regarding operational performance, capital expenditure plans, or financial results. The company’s market presence remained steady, with no significant deviation from its historical trend.

Capital Expenditure and Productivity Dynamics

While Spirax‑Sarco has not announced new capital projects, the broader engineering and manufacturing landscape is undergoing a wave of productivity‑enhancing investments:

- Automation and Digital Twins

- Manufacturers are deploying robotics and digital twin technology to reduce cycle times and enhance predictive maintenance. The integration of AI-driven analytics into process control systems can yield up to a 10 % improvement in throughput for large‑scale production lines.

- Advanced Materials and Process Engineering

- Adoption of high‑strength alloys and additive manufacturing in heavy‑industry components reduces part counts and weight, improving fuel efficiency for downstream users such as power plants and marine vessels.

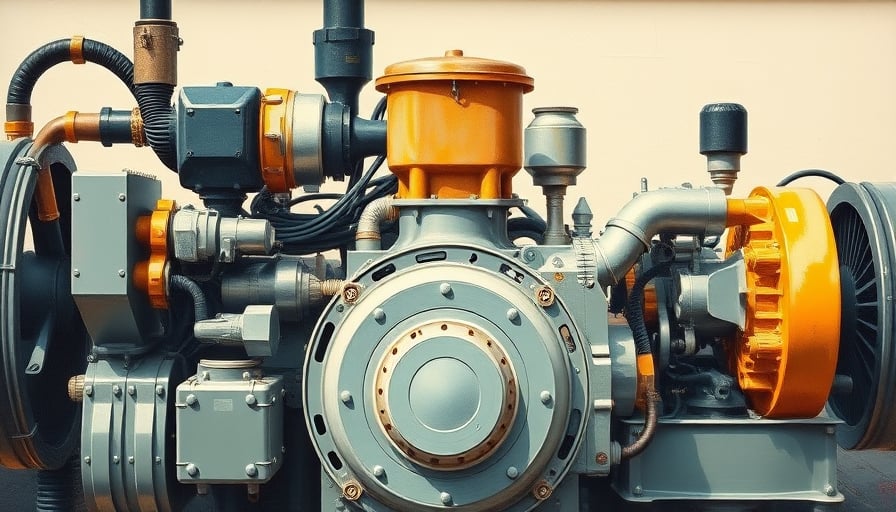

- Energy‑Efficient Equipment

- Modern compressors, heat exchangers, and fluid handling systems are being designed for lower energy consumption. Spirax‑Sarco’s expertise in heat transfer equipment positions the company to supply such solutions as utilities and chemical plants seek to meet stringent carbon‑reduction targets.

Economic Drivers of Capex

- Regulatory Incentives: Stringent emissions regulations in the EU and UK are prompting utilities and industrial operators to upgrade plant infrastructure, providing a steady pipeline of capex opportunities for engineering firms.

- Infrastructure Spending: Public investment in transport and energy infrastructure, driven by climate goals and digitalisation agendas, creates demand for robust, high‑performance engineering solutions.

- Interest Rate Environment: The current low‑to‑mid‑range interest rates, coupled with accommodative fiscal policy, reduce the cost of financing large projects, encouraging companies to lock in new contracts.

Supply Chain and Regulatory Implications

- Supply Chain Resilience: The past year’s disruptions have underscored the need for diversified supplier networks and just‑in‑time inventory management. Firms that invest in real‑time supply chain visibility tools can mitigate risk and maintain production continuity.

- Regulatory Landscape: The European Union’s Machinery Directive and the UK’s Health and Safety Executive (HSE) standards impose rigorous certification requirements on new industrial equipment. Compliance costs are rising, but they also provide a barrier to entry that favors established engineering service providers with proven track records.

Conclusion

Spirax‑Sarco Engineering PLC’s recent share price movements reflect a confluence of sector‑wide headwinds and broader market sentiment. While the company has not announced new operational initiatives, the industry’s trajectory—characterised by automation, advanced materials, and energy‑efficient technologies—continues to drive capital expenditure. Investors and industry analysts should monitor how Spirax‑Sarco capitalises on these productivity trends, particularly as regulatory and economic forces shape the demand for high‑performance engineering solutions in the coming years.