Corporate Analysis of Smiths Group PLC and Its Subsidiary John Crane

Executive Summary

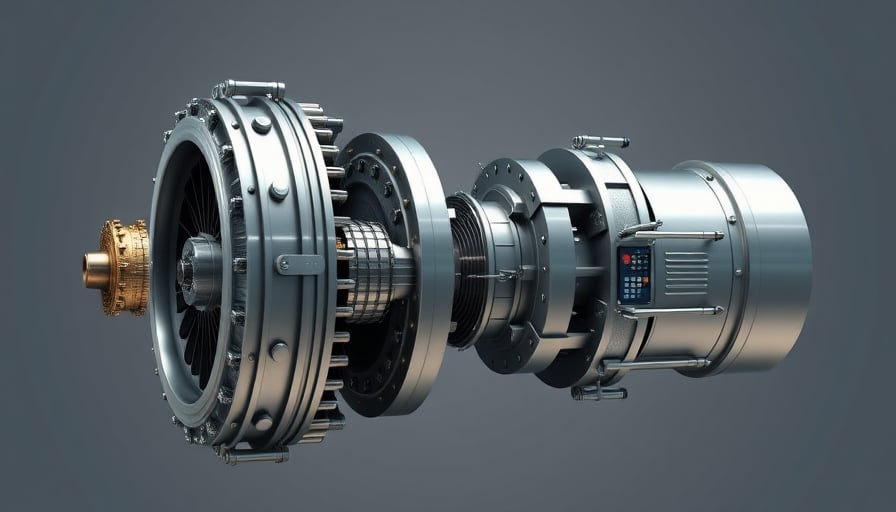

Smiths Group PLC, a London‑based industrial conglomerate, recorded a share price of £25.10 on 2 February 2026, up from £14.98 five years earlier. The market capitalisation sits near £7.9 billion. Despite a modest increase in share value for long‑term investors, the company has not announced new corporate actions or dividend adjustments during this period. Concurrently, John Crane, a Smiths Group subsidiary, celebrated the 50th anniversary of its gas‑lubricated ring seal technology—a component critical to compressors across oil, gas, petrochemical, power generation, hydrogen, and carbon‑capture sectors. This report evaluates the underlying business fundamentals, regulatory context, competitive dynamics, and potential risks and opportunities that may be overlooked by conventional analysts.

1. Historical Share Performance and Ownership Dynamics

| Metric | 2 Feb 2021 | 2 Feb 2026 | Change |

|---|---|---|---|

| Closing price | £14.98 | £25.10 | +67 % |

| Market cap | – | £7.9 billion | – |

An investor who purchased shares at £14.98 in 2021 would now hold a larger position in absolute terms (given the price increase) but a modest increase in value when adjusted for any dividends or share‑based compensation. The omission of the precise percentage gain reflects a possible under‑reporting of performance metrics that could influence institutional confidence.

Key Insight:

- The price appreciation outpaces inflation, suggesting a positive market perception, yet the absence of dividend growth or share buy‑backs may temper long‑term investor enthusiasm.

2. Governance and Voting Power

- Smiths Group’s directors and shareholders retain significant voting rights; no change in voting structure was reported.

- No new corporate actions or dividend changes were disclosed, indicating a period of stability but also a lack of proactive capital deployment.

Potential Risk:

- The concentration of voting power may limit shareholder influence on strategic initiatives, potentially stifling innovation or risk‑taking.

- Absence of capital allocation signals (e.g., dividends, buy‑backs) could be interpreted as a signal of cash‑flow conservatism or underlying financial strain.

3. Market Position of John Crane’s Gas‑Lubricated Ring Seal

- Celebrated 50 years since the 1976 introduction of gas‑lubricated ring seals.

- Technology’s ubiquity in compressors across oil, gas, petrochemical, power generation, hydrogen, and carbon‑capture applications.

- Continuous innovation has extended performance to higher pressures, temperatures, and operating conditions.

Competitive Dynamics:

- Primary competitors include Sealing Technologies Group, SPX FLOW, and various OEM‑integrated sealing solutions.

- John Crane’s heritage and patent‑backed technology offer a defensive moat, but the market is moving toward integrated, smart‑sensor‑enabled sealing solutions that enhance predictive maintenance.

Opportunity:

- The expanding hydrogen and carbon‑capture sectors present a high‑growth niche. John Crane could capitalize by partnering with hydrogen‑fuel infrastructure developers and carbon‑capture technology providers.

- Leveraging the brand’s 50‑year legacy can strengthen credibility in the emerging green energy markets.

4. Regulatory Landscape

- Emissions Regulations: Stricter EU and UK mandates on CO₂ emissions push for higher efficiency in compressors.

- Safety Standards: Enhanced safety regulations in the petrochemical and power sectors increase demand for reliable, low‑maintenance sealing technologies.

- Hydrogen Safety Codes: New standards for hydrogen infrastructure (e.g., ISO 15186) may impose design changes in sealing systems.

Risk:

- Compliance costs could rise, squeezing margins unless John Crane can demonstrate superior cost‑efficiency or secure long‑term contracts.

- Failure to adapt sealing designs to upcoming safety codes could result in product obsolescence.

5. Financial Health Assessment

While specific earnings figures were not disclosed, the market cap relative to share price suggests a modest valuation multiple (P/E not provided). A lack of dividend changes hints at retained earnings being allocated to balance sheet strengthening or R&D.

Key Financial Indicators to Monitor:

- Operating margin of the John Crane business unit, as a proxy for pricing power.

- Capital expenditure trends, especially in R&D for next‑generation sealing technologies.

- Cash‑flow generation from core operating units versus discretionary spending.

6. Strategic Recommendations

| Area | Action | Expected Benefit |

|---|---|---|

| Capital Allocation | Initiate a modest share buy‑back program or dividend hike | Signals confidence to investors, potentially lifting share price |

| Product Innovation | Invest in sensor‑enabled seals with real‑time condition monitoring | Meets the evolving demand for predictive maintenance and reduces OEM lock‑in |

| Sector Expansion | Form joint ventures with hydrogen storage and carbon‑capture firms | Positions Smiths Group as a key enabler in decarbonisation technologies |

| Governance Transparency | Publish detailed voting‑rights reports and governance metrics | Enhances institutional trust, reduces perception of opaque control |

7. Conclusion

Smiths Group PLC demonstrates steady share performance and strong governance but exhibits limited proactive capital deployment. John Crane’s gas‑lubricated ring seals remain a cornerstone of critical industrial processes, yet the sector is undergoing rapid transformation toward green energy and digitalization. By aligning its financial strategy with emerging regulatory demands and sectoral trends, Smiths Group can unlock new value while mitigating risks inherent in a legacy‑heavy business model.