Corporate Commentary from Schroders PLC

Schroders PLC, a London‑based investment‑management group, has recently issued a commentary outlining its strategic outlook on equity markets and natural‑resource investments. The firm expressed a clear preference for U.S. equities and gold, while signalling a reduced appetite for European stocks. In addition, Schroders reaffirmed its bullish stance on the technology sector within Asia, citing advances in artificial intelligence (AI) and liquidity‑provision technologies as catalysts for market activity in 2026, even as fiscal uncertainties in the United States remain a potential headwind. Separately, the company announced a multimillion‑dollar investment in the Canadian mining firm Capitan Silver, underscoring its sustained engagement with resource‑sector opportunities.

Market Context

During the period surrounding these statements, equity market activity was broadly muted. The FTSE 100 finished the trading day with negligible change, reflecting cautious sentiment ahead of the Christmas holiday. European indices likewise ended flat, with trading volumes lower than usual due to the proximity of market closures. In this environment of subdued activity, Schroders’ emphasis on growth‑oriented sectors and strategic asset allocation appears deliberate.

Analytical Overview

1. Preference for U.S. Equities and Gold

Schroders’ tilt toward U.S. equities is consistent with broader market narratives that highlight the resilience of the American economy and its robust corporate earnings framework. U.S. equity markets have historically demonstrated strong capital‑market depth, liquidity, and a concentration of high‑growth companies, particularly within the technology and consumer discretionary sectors. Gold, meanwhile, continues to serve as a defensive asset in times of geopolitical uncertainty and inflationary pressure. By positioning its portfolio with a higher allocation to these assets, Schroders seeks to capture upside potential while mitigating downside risk in a volatile environment.

2. Cautious Stance on European Stocks

The firm’s reduced focus on European stocks aligns with several headwinds facing the region, including regulatory uncertainties, divergent fiscal policies, and slower industrial recovery in certain eurozone countries. European equity markets have also been subject to valuation pressures, especially in the aftermath of the pandemic‑induced rally. Schroders’ approach reflects an analytical assessment that, in the current cycle, U.S. equities and commodities such as gold may offer more attractive risk‑adjusted returns than their European counterparts.

3. Bullish Outlook on Asian Technology

Schroders’ bullish view on Asian technology, especially in the context of AI and liquidity provision, underscores the sector’s continued transformation. AI is increasingly embedded across supply chains, financial services, and consumer platforms, creating systemic value and fostering new competitive dynamics. Liquidity‑provision technologies, including decentralized finance (DeFi) protocols and algorithmic trading platforms, are reshaping market microstructure and enhancing capital accessibility. Schroders anticipates that these innovations will drive substantial market activity through 2026, provided that regulatory frameworks remain conducive to technological experimentation.

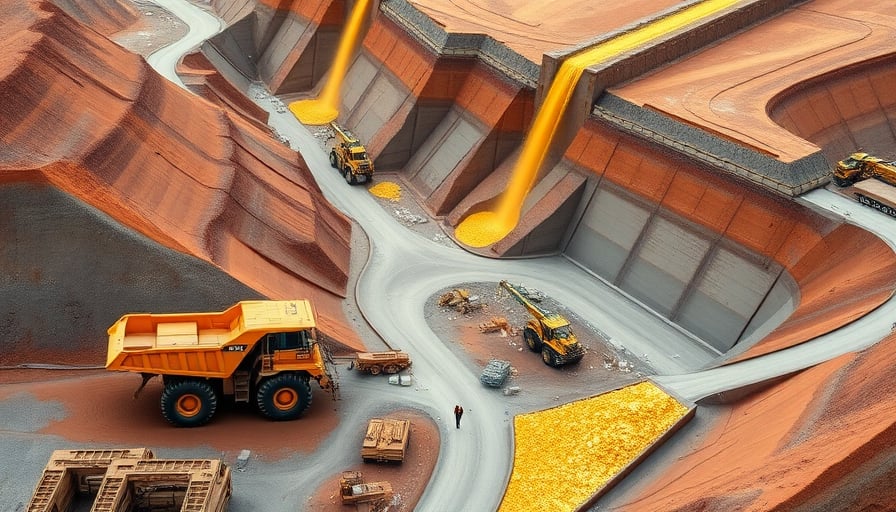

4. Investment in Capitan Silver

The multimillion‑dollar investment in Capitan Silver exemplifies Schroders’ strategic focus on natural resources, a sector that has benefited from heightened global demand for precious metals and mining infrastructure. Capitan Silver operates in a geographically diversified portfolio that includes key mining assets across North America, offering exposure to both exploration and production stages. By allocating capital to this Canadian mining firm, Schroders leverages the sector’s resilience to cyclical downturns and the long‑term demand for silver as an industrial and investment commodity.

Cross‑Sector Connections and Macro Drivers

- Innovation‑Led Growth: The emphasis on AI and liquidity provision in Asia reflects a broader trend of technology-driven growth that transcends individual sectors, influencing everything from financial services to manufacturing.

- Commodity Cycles and Inflation: Gold’s role as an inflation hedge and Capitan Silver’s exposure to commodity demand illustrate how resource sectors can provide diversification benefits in a high‑inflation environment.

- Geopolitical Risk Management: The preference for U.S. equities and gold aligns with risk‑averse positioning in the face of geopolitical tensions, particularly in Europe where political dynamics can spur market volatility.

- Regulatory Landscape: The firm’s commentary implicitly acknowledges that fiscal and regulatory uncertainties—especially in the U.S.—could impact the trajectory of its preferred sectors, necessitating a flexible, data‑driven investment approach.

Conclusion

Schroders PLC’s recent commentary outlines a focused investment thesis that prioritises growth opportunities in technology and natural resources, while adopting a defensive stance through U.S. equities and gold. This strategy reflects a nuanced understanding of current market dynamics, regulatory environments, and macroeconomic forces. By balancing exposure across sectors that offer both high upside potential and robust risk mitigation, Schroders positions itself to navigate the subdued equity landscape ahead of the holiday period and beyond.