Sage Shares Maintain Momentum

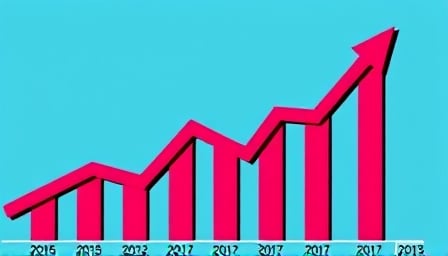

Sage, a stalwart of the FTSE 100, has continued to trade steadily, with its last close price reaching 1223.5 GBP. This steady performance is a testament to the company’s enduring appeal to investors. The company’s 52-week high of 1349 GBP, achieved on February 5, 2025, underscores its market prowess and highlights the confidence that investors have in Sage’s future prospects.

Conversely, the 52-week low of 960 GBP, recorded on October 30, 2024, serves as a reminder of the asset’s volatility. This fluctuation in price is a natural occurrence in the world of finance, and it’s essential to consider it when making investment decisions.

Technical analysis reveals a price-to-earnings ratio of 35.68 and a price-to-book ratio of 15.13, providing valuable insight into Sage’s valuation. These metrics offer a glimpse into the company’s financial health and its ability to generate returns for investors.

- Key metrics:

- Price-to-earnings ratio: 35.68

- Price-to-book ratio: 15.13

- 52-week high: 1349 GBP (February 5, 2025)

- 52-week low: 960 GBP (October 30, 2024)

- Last close price: 1223.5 GBP