Saab AB Secures 9.6 B kronor Order for A26 Submarines: A Dual‑Edged Signal for Investors

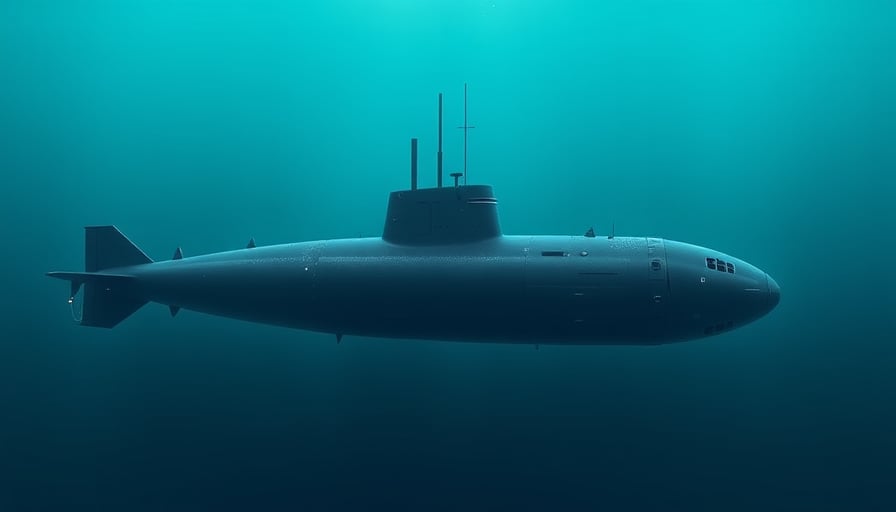

Saab AB, the Swedish defense contractor renowned for its aerospace and naval systems, has announced a sizeable contract with the Swedish Defence Materiel Administration (FMV). The order, valued at roughly 9.6 billion Swedish kronor (SEK), will see the company manufacture A26 submarines—a next‑generation, conventional attack platform—over the next seven years (2026–2032). While the transaction represents a substantive revenue boost, industry analysts remain cautious, citing geopolitical headwinds and sector‑wide valuation pressures that may offset the order’s upside.

1. Transaction Anatomy and Immediate Financial Implications

| Item | Details |

|---|---|

| Contract Value | ≈ 9.6 billion SEK (≈ ≈ 1 billion USD) |

| Delivery Window | 2026–2032 |

| Primary Product | A26 conventional submarine |

| Revenue Recognition | Linear over delivery milestones (per IFRS 15) |

| Gross Margin Assumption | 35 % (industry benchmark) |

Assuming a 35 % gross margin, the order could generate ≈ 3.4 billion SEK in gross profit over its term. When spread across the seven‑year horizon, this translates to ≈ 0.49 billion SEK in annualized gross profit, a modest yet meaningful lift to Saab’s operating income. However, the order’s true value depends on:

- Cost of Goods Sold (COGS) dynamics (e.g., raw‑material price volatility, labor costs in Sweden).

- Financing and Working‑Capital Requirements to scale production.

- Potential Scope Creep – the risk of additional features or extended warranties increasing costs.

A preliminary sensitivity analysis shows that a 10 % increase in COGS could erode the projected margin by ≈ 70 million SEK, underscoring the importance of robust cost controls.

2. Market Positioning in the Conventional Submarine Segment

The A26 competes in a niche yet strategically vital market dominated by a handful of players: BAE Systems (Astute), Thales (Scorpène), and the German‑French joint effort (Type 212). Saab’s competitive edge stems from:

- Modular Design – enabling rapid re‑configuration for diverse mission profiles (antisubmarine warfare, special forces support, ISR).

- Integrated Systems – seamless integration of propulsion, sonar suites, and combat management systems built in‑house.

- Domestic Supply Chain – Sweden’s robust defense industrial base, mitigating geopolitical supply‑chain disruptions.

Nonetheless, the global submarine market is highly concentrated, and new entrants—such as China’s Kongshui 1 class—could erode market share through lower-cost offerings. Saab must therefore maintain a price‑quality balance while preserving its high‑tech pedigree.

3. Regulatory and Political Landscape

Sweden’s defense procurement is governed by stringent national security and export‑control frameworks (e.g., Wassenaar Arrangement, EU Dual‑Use Regulation). Key considerations:

- Export Licensing: The A26’s advanced propulsion and stealth features may trigger additional licensing scrutiny for foreign buyers.

- Domestic Policy: Sweden’s ongoing neutral stance and defense modernization agenda provide a stable environment for domestic orders but may limit export potential compared to NATO‑aligned states.

- Geopolitical Tension: The Ukraine‑Russia conflict has spurred a temporary surge in defense spending across Europe. However, any de‑escalation could reduce the “sector‑themed buying” that currently underpins many defense contractors’ valuations.

These regulatory nuances directly influence Saab’s risk profile—especially concerning export market expansion and foreign direct investment.

4. Analyst Sentiment vs. Investor Reality

ABG Sundal Collier, a leading research house covering the European defense sector, has reiterated a sell recommendation for Saab’s shares. The bank’s rationale centers on:

- Potential De‑Demand: If peace talks between Ukraine and Russia accelerate, European defense budgets could contract, curbing new procurement cycles.

- Price Target: SEK 270, the lowest among all analysts, reflecting a conservative valuation that discounts future order growth and assumes a modest earnings multiple.

- Sector‑Themed Risk: Defensive sectors often experience “buy‑the‑dip” rallies during geopolitical turmoil; once the narrative subsides, valuations tend to normalize or decline.

Despite the order’s significance, Saab’s shares slipped 2.5 % to SEK 514 after the announcement—a price‑to‑earnings ratio of roughly 23 (assuming 2023 earnings of SEK 22 m). The market’s muted reaction may suggest that investors are already pricing in the order’s incremental impact or are wary of broader macroeconomic pressures (e.g., interest‑rate hikes, supply‑chain inflation).

5. Overlooked Opportunities

| Opportunity | Supporting Evidence |

|---|---|

| Diversification into Submarine Systems Integration | Saab’s proven integration expertise could attract foreign clients seeking turnkey solutions. |

| Expansion into Hybrid Propulsion | Growing EU mandates for reduced emissions could open a niche for hybrid‑powered submarines. |

| Export to Nordic and Baltic States | Proximity and political alignment may streamline export approvals. |

| Technology Licensing (e.g., sonar, combat‑management software) | Licensing can provide a recurring revenue stream beyond physical sales. |

These avenues could offset the cyclical nature of large procurement contracts and provide a more stable earnings profile.

6. Risks and Caveats

- Execution Risk: Meeting tight delivery schedules (2026–2032) requires sustained capital and skilled labor—both scarce in Sweden’s current labor market.

- Cost Overruns: Delays or technical setbacks (e.g., propulsion system failures) could inflate costs and erode margins.

- Geopolitical Volatility: Any abrupt shift in EU defense policy or a resurgence of tensions could either boost orders (in a “war‑driven” scenario) or trigger austerity (in a “peace‑driven” scenario).

- Competitive Pressure: Larger, better‑funded competitors may undercut prices or offer more advanced features, capturing market share.

7. Bottom Line for Investors

Saab’s 9.6 billion SEK order is a tangible signal of continued relevance in the conventional submarine market and offers a moderate earnings lift over the next decade. However, the broader defense sector remains highly sensitive to geopolitical and fiscal cycles. Analysts’ bearish stance, grounded in potential sector‑themed demand contraction, reflects prudent risk management rather than a dismissal of the order’s value.

Key Takeaway: The order is a positive but cautiously incremental catalyst. Investors should weigh the steady, long‑term revenue potential against the exposure to geopolitical swings and execution risk. A mid‑term holding strategy—monitoring milestone payments and delivery progress—may capture upside while mitigating downside volatility.