Qnity Electronics Inc. Boosts Dividend and Announces Leadership Change in Semiconductor Division

Qnity Electronics Inc. (QNE) has announced a substantial increase in its quarterly dividend, raising the payment to $0.08 per share—approximately a one‑third uplift from the prior amount. The move comes in tandem with a leadership transition within the company’s semiconductor technologies division, where Sam Ponzo has been named interim president following the departure of Sang Ho Kang.

Dividend Upgrade: Signals Confidence and Shareholder Value

The dividend increase signals Qnity’s confidence in its cash‑flow generation and its commitment to delivering value to shareholders. Analysts note that a higher dividend payout often reflects stable earnings and a robust balance sheet. In Qnity’s case, the adjustment follows a series of successful product launches in the advanced packaging and logic‑level solutions segments, which have strengthened the company’s revenue base.

- Dividend Yield Impact: At a share price hovering around the upper end of its 52‑week range, the $0.08 dividend translates to a yield of roughly 1.2%—moderate by semiconductor industry standards, where yields typically range from 0.5% to 2.5% depending on growth prospects.

- Capital Allocation Strategy: By increasing dividends, Qnity signals a balanced approach to capital allocation, preserving cash for R&D while rewarding investors—a strategy that can enhance the company’s cost of capital.

Leadership Transition in Semiconductor Technologies

Sam Ponzo’s appointment as interim president of the semiconductor technologies division follows the exit of Sang Ho Kang, who had steered the unit through a period of rapid expansion. Ponzo, previously the senior director of product development, brings extensive experience in advanced packaging and high‑performance logic design.

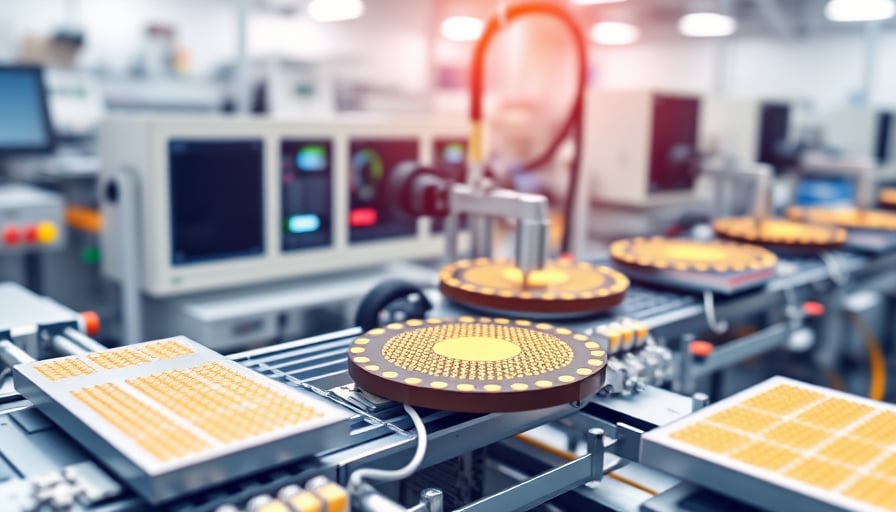

- Strategic Focus: Under Ponzo, the division is expected to accelerate the commercialization of heterogeneous integration solutions, a key trend in the industry that enables higher bandwidth and lower power consumption in next‑generation chips.

- Operational Continuity: The interim designation provides continuity while the board conducts a full search for a permanent president, minimizing disruption to ongoing projects such as Qnity’s collaboration with leading OEMs on AI accelerator platforms.

Market Context and Investor Sentiment

Qnity’s shares have been trading near the upper boundary of their 52‑week range, reflecting heightened investor interest in the company’s semiconductor activities. This uptick aligns with broader market enthusiasm for firms that are delivering edge‑computing and AI‑optimized silicon solutions.

- Sector Growth: The semiconductor sector is projected to grow at a CAGR of 6–7% over the next five years, driven by demand for IoT, 5G, and autonomous vehicle technologies. Companies with strong IP portfolios and flexible manufacturing capabilities—like Qnity—are well positioned to capture this momentum.

- Risk Considerations: Investors should monitor potential supply chain constraints, particularly in the availability of advanced lithography equipment and rare‑earth materials, which could impact production timelines and cost structures.

Implications for IT Decision‑Makers

For organizations evaluating semiconductor partners, Qnity’s recent developments offer several takeaways:

- Financial Stability: The dividend hike indicates a healthy balance sheet, suggesting the company can sustain R&D investments without compromising liquidity.

- Leadership Expertise: Ponzo’s background in packaging and logic design may accelerate delivery of integrated solutions, a critical factor for enterprises needing rapid time‑to‑market.

- Market Positioning: Qnity’s alignment with emerging trends such as edge AI and heterogeneous integration positions it as a credible supplier for future‑proofed infrastructures.

In summary, Qnity Electronics Inc.’s dividend enhancement and leadership transition signal both financial strength and strategic focus within the semiconductor domain. IT leaders and software professionals should view these moves as indicators of the company’s readiness to support evolving technological demands while maintaining shareholder value.