Prysmian SpA: The Italian Cable Giant on a Roll

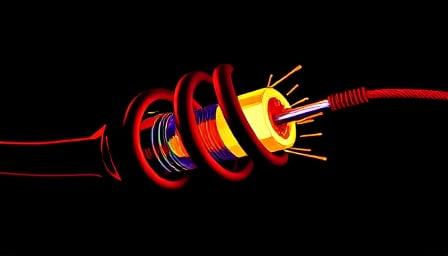

Prysmian SpA, the Italian cable production powerhouse, is making waves in the industry with its innovative products and strategic acquisitions. The company’s recent Top Project of the Year Award from Environment+Energy Leader for its Advanced E3X Conductors with Green and Recycled Materials is a testament to its commitment to sustainability and innovation.

But Prysmian’s success story doesn’t end there. The company’s financials are also looking up, with a whopping 35% EBITDA margin in 2024. This impressive figure indicates a positive trend that is likely to continue, making Prysmian an attractive investment opportunity.

The company’s strategic acquisitions, including the purchase of Channell, a cable manufacturer, for a significant amount, are expected to boost Prysmian’s growth prospects. This move demonstrates Prysmian’s commitment to expanding its market share and increasing its competitiveness.

But what’s behind Prysmian’s success? Is it the company’s innovative products, its strategic acquisitions, or something else entirely? The answer lies in the company’s ability to adapt to changing market trends and customer needs.

Here are the key takeaways from Prysmian’s recent success:

- Innovative products: Prysmian’s Advanced E3X Conductors with Green and Recycled Materials have earned the company a Top Project of the Year Award from Environment+Energy Leader.

- Strong financials: Prysmian’s 35% EBITDA margin in 2024 indicates a positive trend that is likely to continue.

- Strategic acquisitions: The company’s purchase of Channell, a cable manufacturer, is expected to boost Prysmian’s growth prospects.

- Attractive valuation: Prysmian’s valuation is considered attractive, with a rating upgrade suggesting potential upside.

In conclusion, Prysmian SpA is on a strong trajectory, driven by its innovative products and strategic acquisitions. The company’s commitment to sustainability and innovation is paying off, making it an attractive investment opportunity for investors.