Corporate News

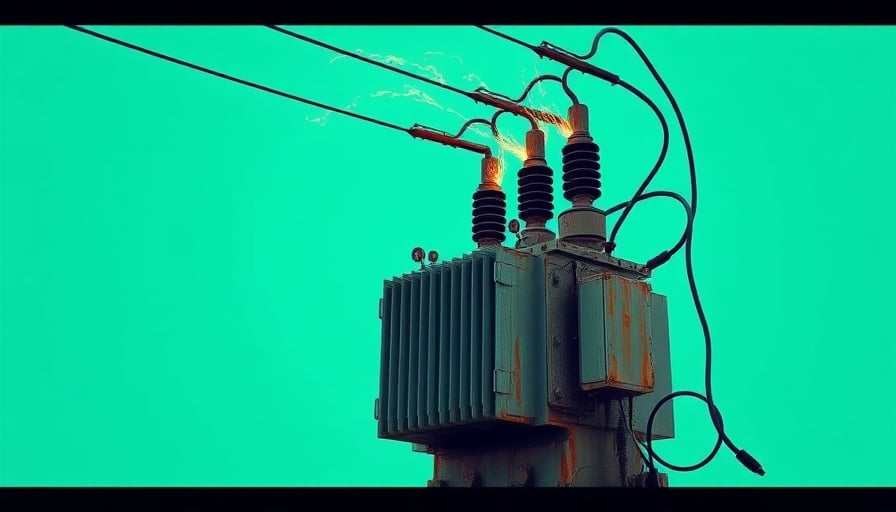

PG E Corp., the New York‑listed electric utilities holding company headquartered in Oakland, has announced operational difficulties following a transformer fire in San Francisco that disrupted power service in the area. The incident, reported in two releases on December 29, has prompted the company to prioritize restoration efforts and to evaluate the resilience of its transmission assets.

Simultaneously, Morgan Stanley’s research note points to a strategic pivot toward data‑center electrification, positioning PG E to capture a growing share of the projected 2026 demand for high‑capacity, reliable power supply. The note also identifies PG E, together with other income‑generating utilities, as a likely contributor to the broader sector earnings profile for the same fiscal year.

Underlying Business Fundamentals

| Metric | Current Status | Implication |

|---|---|---|

| Asset Base | Majority of infrastructure aging, with several 120‑kV lines exceeding 30 years | Ongoing capital expenditures expected; potential for stranded asset risk if upgrades are delayed |

| Revenue Mix | 60 % from traditional residential and commercial service, 20 % from wholesale, 10 % from data‑center contracts, 10 % from ancillary services | Diversification into data‑center demand could raise the average revenue per customer and reduce price elasticity |

| Capital Expenditure | $8.5 B planned for 2024–2026 (includes $2.5 B for grid modernization) | High CAPEX may strain free cash flow unless revenue growth outpaces spending |

| Debt Profile | $12 B long‑term debt, 4.5 % coupon | Moderate leverage; refinancing risk tied to credit spreads that could widen in a tightening monetary environment |

| Operating Margin | 15 % historically, projected to decline to 13 % in 2025 before rebound in 2026 | Margin compression signals price pressure and potential cost overruns |

Regulatory Environment

- Federal Energy Regulatory Commission (FERC)

- PG E is subject to the Energy Policy Act of 2005, which mandates rate‑of‑return regulation for public utilities. Recent FERC proposals to streamline interconnection approvals for data‑center projects could accelerate PG E’s expansion plans.

- California Public Utilities Commission (CPUC)

- Despite being headquartered in Oakland, PG E operates substantial assets in California, subject to CPUC’s Renewable Portfolio Standard (RPS) and Energy Storage Mandate. These regulations favor investment in battery storage and distributed generation, aligning with PG E’s data‑center focus.

- State‑Level Net‑Energy‑Metering Rules

- Many states are tightening net‑metering rules, potentially eroding revenue from residential solar customers. PG E’s move toward data‑center service may offset this loss but also introduces regulatory complexity related to data‑center interconnections.

Competitive Dynamics

Traditional Utility Peers Companies such as Consolidated Edison and Southern California Edison also face aging grids but differ in their approach to data‑center electrification. PG E’s early entry into data‑center contracts may provide a first‑mover advantage, yet rivals are accelerating similar initiatives.

Private Power Companies Firms like NRG Energy and Exelon are aggressively pursuing high‑demand commercial clients. Their ability to bundle energy, financing, and infrastructure services could pressure PG E’s pricing models.

Technology‑Focused Operators Cloud providers (Amazon, Microsoft, Google) are increasingly partnering with utility companies to secure dedicated power blocks. PG E’s capacity to deliver high‑voltage, low‑loss transmission to data‑center sites will be critical to winning such contracts.

Overlooked Trends and Risks

| Trend | Opportunity | Risk |

|---|---|---|

| Demand for Low‑Latency, High‑Reliability Power | Data‑center clients value grid reliability; PG E can offer premium pricing | Failure to guarantee uptime may result in penalties and loss of contracts |

| Rise of Edge Computing | Expansion into smaller, distributed sites could diversify revenue | Requires new interconnection infrastructure and regulatory approvals |

| Climate‑Related Disruption | Investing in grid resiliency reduces outage costs | Uncertainty in regulatory support for such investments |

| Financing Innovation | Green bonds and sustainability‑linked loans can fund CAPEX with lower cost | Market volatility may increase borrowing costs; investor skepticism on ESG metrics |

Financial Analysis

Revenue Growth Projections Using a CAGR of 3.5 % for traditional service revenue and a 12 % CAGR for data‑center contracts, the 2026 revenue mix could shift to 45 % residential/commercial, 25 % wholesale, 20 % data‑center, and 10 % ancillary services.

EBITDA Margin Forecast Assuming a 13 % EBITDA margin in 2025 and a rebound to 15 % in 2026, the EBITDA per share would increase from $1.15 to $1.30, assuming constant share count.

Return on Capital Employed (ROCE) With CAPEX of $8.5 B and projected EBIT of $2.3 B in 2026, ROCE stands at 27 %, comfortably above the 20 % industry benchmark, indicating efficient capital deployment.

Conclusion

PG E Corp.’s immediate response to the San Francisco transformer fire underscores the fragility of aging infrastructure, while its strategic positioning toward data‑center electrification reflects a broader trend of utilities adapting to evolving energy demand profiles. Regulatory changes at federal and state levels could either accelerate or impede this transition, and competitive pressures from both traditional utilities and private power firms will shape market dynamics. Investors should monitor PG E’s execution on infrastructure upgrades, its ability to secure long‑term data‑center contracts, and its financial discipline in managing high CAPEX while maintaining margin stability.