Panasonic’s Clean Energy Play: A Growth Opportunity Worth Betting On

Panasonic Holdings Corp’s stock price may have been experiencing some turbulence lately, but make no mistake - the company is poised to ride the wave of a rapidly growing industry. The global fuel cell generator market is projected to explode, with a staggering compound annual growth rate of 21.2% from 2024 to 2029. And Panasonic is perfectly positioned to cash in on this trend.

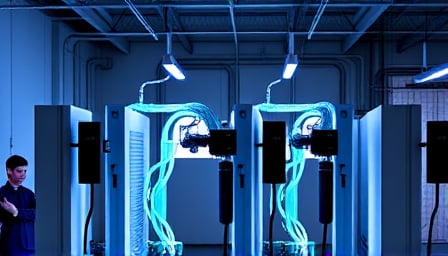

The driving force behind this growth is the increasing demand for clean energy, fueled by governments’ ambitious climate goals and a growing awareness of the need to transition away from fossil fuels. As a leading multinational corporation with a diverse portfolio of products, Panasonic is uniquely equipped to capitalize on this shift. Its focus on developing innovative clean energy solutions, such as fuel cell generators, is a strategic move that will pay off in the long run.

Here are the key statistics that make a compelling case for investing in Panasonic:

- Global fuel cell generator market projected to grow at a CAGR of 21.2% from 2024 to 2029

- Increasing demand for clean energy driven by climate goals and government support

- Panasonic’s focus on clean energy solutions positions the company for long-term growth

- Diversified product portfolio makes Panasonic a well-rounded investment opportunity

Don’t be fooled by short-term market fluctuations - Panasonic’s clean energy play is a bet worth making. With its strong track record, innovative products, and strategic focus on the growing clean energy market, this company is poised to deliver impressive returns for investors.