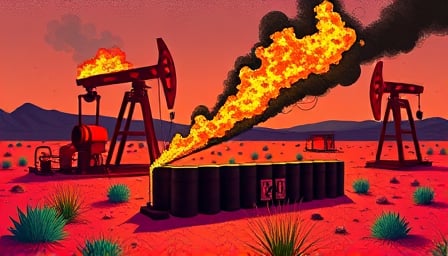

Energy Stocks on Fire: Occidental Petroleum’s Meteoric Rise

In a stunning display of market resilience, Occidental Petroleum Corp has left its industry in the dust, with its stock price skyrocketing by a whopping 100% in just two months. The company’s shares have been on a tear, fueled by the perfect storm of rising tensions in the Middle East and a surge in crude oil prices.

The Geopolitical Wildcard

Rising tensions between Israel and Iran have created a perfect environment for energy stocks to thrive. The uncertainty and volatility in the region have sent crude oil prices soaring by nearly 5%, with no end in sight. This seismic shift has had a direct impact on Occidental Petroleum’s stock, which has benefited from the increased demand for oil.

The Numbers Don’t Lie

Here are the key statistics that highlight Occidental Petroleum’s remarkable performance:

- 100% increase in stock price over the last two months

- 5% jump in crude oil prices, driven by geopolitical uncertainty

- Occidental Petroleum’s stock has outperformed its industry, leaving competitors in the dust

- The company’s shares have risen sharply, with no signs of slowing down

A New Era for Energy Stocks

The recent surge in Occidental Petroleum’s stock price is a clear indication that the energy sector is poised for a major comeback. As tensions in the Middle East continue to escalate, investors are taking notice of the opportunities that lie ahead. With its stock price on the rise, Occidental Petroleum is well-positioned to capitalize on the growing demand for oil and cement its position as a leader in the energy industry.