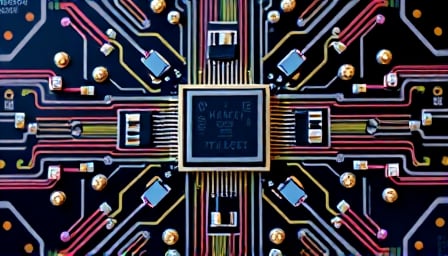

NXP Semiconductors Sees Stock Price Fluctuations Amid Market Trends

NXP Semiconductors NV, a leading global semiconductor company known for designing innovative semiconductors and software, has been navigating the ups and downs of recent market fluctuations. The company’s stock price has been a subject of interest among investors, with its shares currently trading without dividend rights.

According to Factset, NXP Semiconductors has announced a payout of $1.014 per share, a move that may have some impact on the company’s stock price. However, this development is not the only factor influencing NXP’s stock performance. Morgan Stanley, a prominent investment firm, has reaffirmed its rating for the company, citing attractive valuation as a key reason for its positive outlook.

The overall market trend has also played a significant role in shaping NXP’s stock price. The NASDAQ 100 index, a benchmark for the tech-heavy NASDAQ stock market, has experienced moderate gains in recent days. While this may have contributed to NXP’s stock fluctuations, the company remains optimistic about its long-term prospects.

NXP’s products are in high demand across various sectors, including automotive, identification, and wireless infrastructure. As the global demand for these products continues to grow, NXP is well-positioned to capitalize on this trend. With its innovative semiconductor designs and software solutions, the company is poised to remain a leader in the industry.

Key Takeaways:

- NXP Semiconductors’ stock price has been influenced by recent market fluctuations and the company’s payout announcement.

- Morgan Stanley has reaffirmed its rating for NXP, citing attractive valuation.

- The company’s long-term prospects remain positive, driven by growing demand for its products in key sectors.

- NXP’s innovative semiconductor designs and software solutions position the company for continued growth and success.