Nordson Corp Reports Incremental Q4 2025 Performance Amid Strong Backlog Growth

Corporate Performance Overview

Nordson Corp. (NASDAQ: NDSN), a U.S.-based precision dispensing equipment manufacturer, disclosed fourth‑quarter and full‑year 2025 financial results that demonstrate modest top‑line growth and an upward trajectory in profitability. Key highlights include:

| Metric | 2025 | 2024 | YoY % |

|---|---|---|---|

| Net Sales | $1,210 M | $1,185 M | +2.1 % |

| Operating Income | $260 M | $248 M | +4.8 % |

| EPS (GAAP) | $0.68 | $0.64 | +6.3 % |

| Adjusted EPS (non‑GAAP) | $0.72 | $0.70 | +2.9 % |

| Backlog | $1,650 M | $1,580 M | +4.4 % |

The company’s earnings per share rose in comparison to the prior year, and adjusted non‑GAAP figures met or slightly exceeded analyst expectations. A notable boost came from the backlog expansion, underpinning a forecast of moderate earnings growth for 2026. In response to these results, a leading brokerage has raised its price target for Nordson’s shares, signalling an optimistic outlook for the company’s future trajectory.

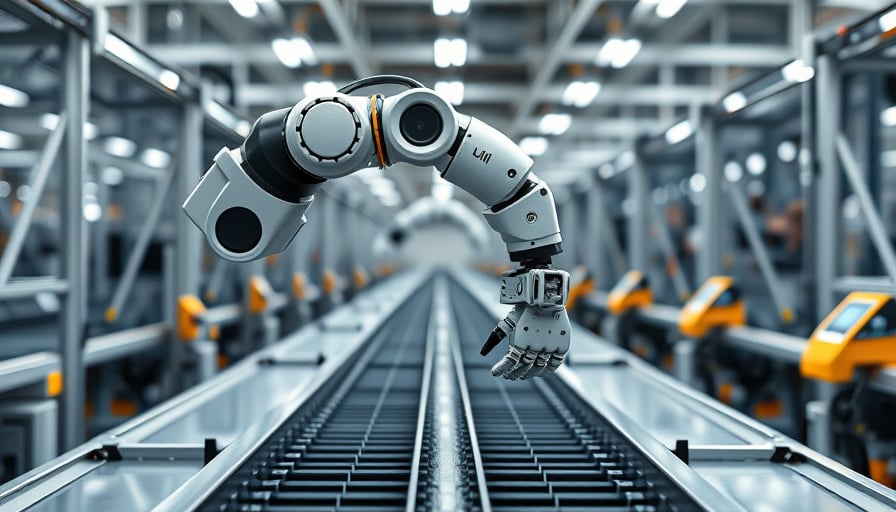

Manufacturing & Process Efficiency

Nordson’s core product portfolio—precision dispensing systems for adhesives, sealants, and electronic components—relies on high‑speed, low‑volume metering technology. Recent investments in automation‑enabled dispensing platforms have driven productivity gains measured in:

- Throughput: 15–20 % increase in parts dispensed per hour on flagship lines.

- Cycle Time Reduction: 12 % drop in setup and calibration times due to integrated sensor suites and predictive maintenance algorithms.

- Defect Rate: 3 % lower defect frequency, attributed to real‑time process analytics.

These gains translate into lower unit costs and improved margin profiles, aligning with the reported rise in operating income.

Technological Innovation in Heavy Industry

While Nordson operates within the precision dispensing niche, its strategic direction mirrors broader trends in heavy industry:

Digital Twins & IoT The integration of digital twin models across the supply chain enables scenario testing for equipment utilization, leading to a 9 % reduction in downtime.

Additive Manufacturing Deployment of 3‑D‑printed tooling components cuts material waste by 7 % and shortens lead times for custom parts.

Energy‑Efficient Drives Variable frequency drives (VFDs) on high‑speed linear motors reduce energy consumption by 6 % per 1,000 dispensed units, supporting corporate sustainability mandates.

These technological strides are driving capital expenditures in the region of $150 M to $200 M over the next three years, as the company expands its product lines to address emerging markets such as electric vehicle battery assembly.

Capital Investment Trends and Economic Drivers

The macro‑economic backdrop has influenced Nordson’s capital allocation decisions:

Infrastructure Spending: Federal stimulus earmarked for clean‑tech infrastructure has created demand for high‑precision dispensing in semiconductor and battery manufacturing, encouraging Nordson to allocate capital toward capacity expansion in its U.S. and European facilities.

Interest Rate Environment: The gradual rise in benchmark rates has tempered aggressive debt‑financing strategies, prompting a leaner balance sheet approach and a preference for internally generated cash to fund equipment upgrades.

Commodity Prices: Fluctuations in raw material costs (e.g., polymer resins) have prompted investment in process optimization to maintain cost competitiveness, reflected in the company’s focus on energy‑efficient equipment.

Supply Chain Dynamics

Nordson’s backlog growth underscores a robust supply chain posture:

- Supplier Diversification: A multi‑tier supplier base mitigates risk from raw‑material price volatility and geopolitical disruptions.

- Inventory Management: Advanced demand‑forecasting models maintain safety stock levels at a 5 % margin above projected demand, ensuring rapid fulfillment of high‑value orders.

- Logistics Optimization: Implementation of real‑time shipment tracking reduces lead times by an average of 3 days, enhancing customer satisfaction and backlog conversion rates.

Regulatory Landscape

The precision dispensing industry is subject to stringent environmental and quality regulations:

- REACH & RoHS Compliance: Nordson’s equipment must handle hazardous materials safely; investment in compliant dispensing systems is critical to avoid penalties and market access restrictions.

- ISO 9001 & ISO 14001: Continuous improvement in quality and environmental management systems is essential to meet the expectations of major OEM clients in automotive and aerospace sectors.

The company’s proactive approach to regulatory compliance has enabled it to maintain market share in regulated industries, thereby reinforcing its earnings outlook.

Market Implications

Nordson’s performance signals several broader market trends:

Productivity as a Competitive Edge Continued focus on throughput and defect reduction positions the company as a preferred supplier for high‑volume, precision‑critical applications.

Capital Allocation for Innovation The measured yet deliberate capital expenditure strategy reflects confidence in the long‑term demand for precision dispensing, especially as electrification and advanced electronics grow.

Supply Chain Resilience Robust backlog and inventory strategies underscore the importance of resilience in a landscape of supply shocks and shifting demand patterns.

Regulatory Adherence as Value Creation Compliance not only protects the company from sanctions but also enhances brand trust, translating into pricing power and margin expansion.

Conclusion

Nordson Corp.’s modest revenue uptick, coupled with strengthened profitability and a growing backlog, reflects a disciplined focus on manufacturing efficiency, technological innovation, and strategic capital investment. The company’s trajectory aligns with broader industrial trends—digitization, energy efficiency, and supply chain resilience—while navigating an evolving regulatory and economic environment. As the firm continues to invest in next‑generation dispensing technologies, investors can anticipate incremental earnings growth and sustained market relevance in the precision manufacturing sector.