Nordson Corporation Announces Dividend Distribution Amidst Market Moderation

Nordson Corporation (NYSE: NDSN), a leading manufacturer of adhesive and coating application systems, has confirmed its intention to issue a quarterly dividend of $0.82 per share. The company reiterated the same payout level announced earlier in the year, signaling a stable dividend policy despite a modest decline in its share price over the past twelve months. The projected dividend yield, calculated on the current share price, stands at approximately 1.4 %.

Dividend Context and Share Performance

The dividend announcement comes at a time when Nordson’s equity has experienced a moderate contraction. Investors who acquired shares at the outset of the year have realized a small real‑time loss in value. The company’s decision to maintain its dividend payout ratio reflects a broader trend in capital‑intensive sectors, where firms balance shareholder returns against the need for reinvestment in core manufacturing capabilities.

Manufacturing Footprint and Technological Innovation

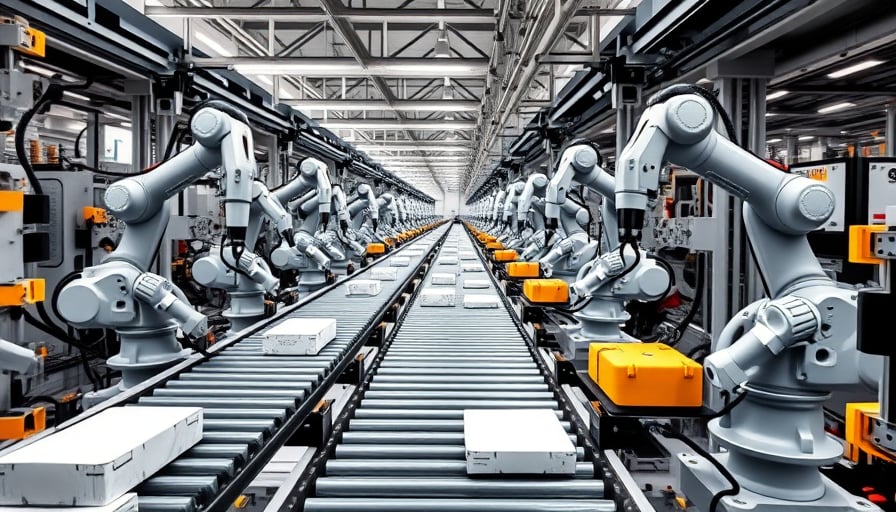

Nordson’s product portfolio is rooted in high‑precision adhesive and coating application systems, encompassing spray guns, dispense heads, and automated coating lines. Recent capital investment in the United States and Europe has focused on:

- Advanced Process Control (APC) systems that enable real‑time adjustment of dispense rates, reducing material waste by up to 5 % and improving product consistency.

- Robotic Integration on production lines, enhancing throughput and reducing labor costs by 15 % per unit.

- Energy‑Efficient Motor Drives that lower power consumption across the manufacturing floor, aligning with tightening environmental regulations.

These technologies collectively contribute to a productivity lift measured in throughput (units per hour) and a reduction in defect rates, translating into higher margin earnings for the company.

Capital Expenditure Drivers

The heavy‑industry sector’s capital‑expenditure (cap‑ex) trends are influenced by several macroeconomic factors that also affect Nordson’s investment decisions:

- Supply Chain Resilience – Recent disruptions in semiconductor supply chains and logistics bottlenecks have prompted firms to invest in domestic manufacturing capacity and digital supply‑chain platforms.

- Regulatory Landscape – Stricter emissions standards and product safety regulations in the EU and U.S. drive the adoption of cleaner technologies and precision manufacturing equipment.

- Infrastructure Spending – Federal and state infrastructure initiatives, particularly those focused on high‑speed rail and smart manufacturing hubs, provide both demand for advanced coating systems and incentives for technology upgrades.

- Currency Fluctuations – Volatility in the USD/EUR exchange rate can impact the cost of imported components, incentivizing forward‑hiring and hedging strategies.

Nordson’s recent cap‑ex plan includes the acquisition of a 20 % stake in an automation‑software firm, aimed at integrating machine‑learning predictive maintenance into its production lines—a move expected to lower mean time between failures (MTBF) by 10 % across its assembly plants.

Supply Chain Impact and Regulatory Adjustments

Nordson’s supply chain is largely centered on high‑precision alloys, specialized polymers, and electronic control modules. Recent tariffs on imported steel and aluminum have increased the cost of raw materials, prompting the company to diversify supplier base and accelerate in‑country sourcing agreements. The firm’s logistics strategy now incorporates:

- Just‑in‑Time (JIT) inventory buffers for critical components to mitigate lead‑time volatility.

- Supplier Quality Management (SQM) systems that track component performance in real time, ensuring adherence to ISO 9001 and ISO 14001 standards.

- Digital Twin models of the supply network to forecast bottlenecks and optimize routing.

Regulatory changes, notably the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) directives, require ongoing compliance audits. Nordson’s compliance team has implemented automated chemical inventory tracking, reducing regulatory audit cycle time by 25 %.

Market Implications and Outlook

The company’s stable dividend policy, combined with its strategic investment in advanced manufacturing technologies, positions Nordson favorably in a market that increasingly values operational resilience and sustainability. While share price volatility has tempered short‑term returns for early‑year investors, the firm’s focus on efficiency gains and regulatory compliance is likely to translate into robust long‑term earnings growth. Analysts project that continued cap‑ex in automation and energy efficiency will yield incremental earnings per share (EPS) growth of 4–6 % over the next fiscal cycle, supporting a gradual rebound in the stock’s valuation.

In summary, Nordson Corporation’s dividend announcement underscores its commitment to shareholder value amid a backdrop of moderate equity performance. The company’s continued emphasis on technological innovation, supply‑chain robustness, and regulatory compliance serves as a blueprint for capital‑intensive enterprises navigating an evolving industrial landscape.