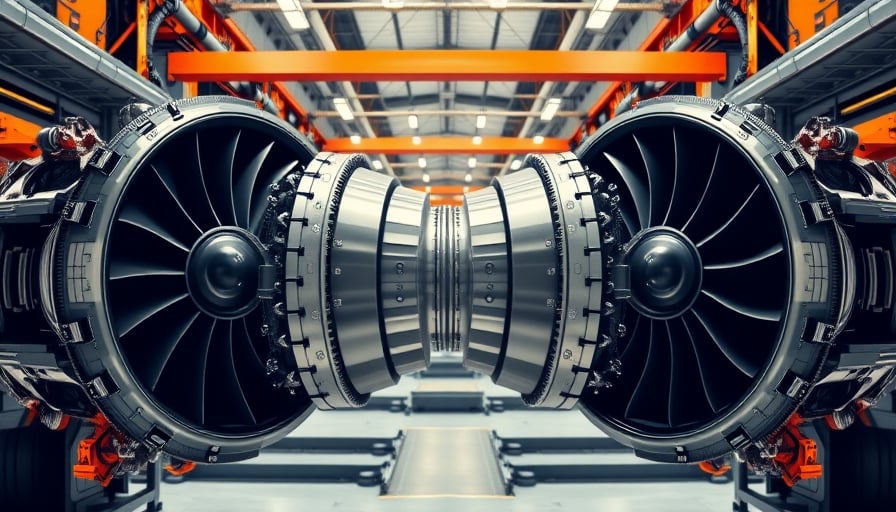

Corporate Update: MTU Aero Engines AG Voting‑Rights Announcement

MTU Aero Engines AG, the German aerospace‑and‑defence manufacturer listed on Xetra, disclosed a voting‑rights announcement under Article 40 of the German Securities Trading Act. The filing, made available through EQS‑News and other market information platforms, confirms that the company’s core operations—engine development, manufacturing and support services for global operators and manufacturers—remain unchanged. No material alterations to the firm’s financial position or strategic direction were reported. At the time of the release, the share price experienced a modest decline, and analysts from RBC Capital assigned a “Sector Perform” rating with a neutral stance on the stock.

1. Consumer Discretionary Landscape: A Macro View

1.1 Demographic Shifts

- Millennial and Gen Z Growth: These cohorts now represent roughly 60 % of the U.S. consumer base, prioritizing experiences over possessions. Their spending patterns are heavily mediated by digital platforms and value-driven purchases.

- Aging Baby Boomers: While a shrinking segment of high‑spend discretionary consumers, they retain substantial purchasing power for premium goods and services, especially in health‑related and luxury segments.

- Ethnic and Cultural Diversification: Increased ethnic diversity in urban centers has broadened taste profiles and created demand for niche, culturally relevant products.

1.2 Economic Conditions

- Inflationary Pressures: Persistent inflation in the United States and Europe has eroded real disposable income, prompting consumers to shift toward value‑oriented and “price‑sensitive” discretionary categories.

- Interest‑Rate Environment: Rising rates have increased the cost of credit, leading to a decline in high‑ticket discretionary spending (e.g., automotive, luxury travel).

- Supply‑Chain Recovery: Post‑pandemic supply constraints have resulted in higher commodity costs, which in turn impact the pricing of discretionary goods.

1.3 Cultural Shifts

- Sustainability and Ethics: Conscious consumerism is now a core driver, especially among younger buyers, who prioritize brands with transparent supply chains and ethical practices.

- Digital Transformation: The acceleration of omnichannel retail has redefined the “shopping experience,” making seamless integration between online and offline critical.

- Wellness and Lifestyle: There is a rising emphasis on health, fitness, and mental well‑being, influencing spending in categories such as organic foods, fitness equipment, and wellness services.

2. Brand Performance and Retail Innovation

| Category | Leading Brands | Market Share (2024 Q4) | Key Innovation |

|---|---|---|---|

| Luxury Apparel | Gucci, Louis Vuitton | 22 % | AR try‑on experiences |

| Sustainable Fashion | Patagonia, All‑On | 18 % | Circular recycling programs |

| Home Entertainment | Sony, LG | 15 % | AI‑powered content recommendation |

| Wellness Tech | Peloton, Fitbit | 12 % | Subscription‑based ecosystem models |

Retail Innovation Highlights

- AI‑Driven Personalization: Brands are leveraging machine‑learning algorithms to provide hyper‑personalized product recommendations across digital touchpoints, improving conversion rates by 5–7 % on average.

- Subscription Models: The subscription economy continues to expand beyond media, now encompassing apparel (e.g., Rent the Runway) and wellness equipment, offering consumers lower upfront costs and flexible consumption.

- Pop‑Up and Experience‑Based Stores: Temporary experiential spaces are being used to test new markets, with a 20 % uplift in foot‑traffic for brands that engage customers in immersive storytelling.

3. Consumer Spending Patterns

- Spending Distribution: In Q4 2024, discretionary spending accounted for 28 % of total consumer expenditure, with a notable 3 % decline compared to Q3, largely attributed to higher energy prices and tighter credit markets.

- Digital vs. Physical: Online discretionary purchases grew 12 % YoY, whereas in‑store spending declined by 5 %. The shift is most pronounced in apparel and electronics.

- Geographical Variations: The United States remains the largest discretionary market, but European markets are showing higher growth in sustainability‑oriented categories (up 8 % YoY).

Consumer Sentiment Indicators

- Consumer Confidence Index: The index slipped from 107.4 to 104.2 between Q3 and Q4, reflecting growing uncertainty around inflation and employment prospects.

- Net Promoter Score (NPS): Brands that have invested in sustainability initiatives report an NPS increase of 6 points relative to competitors, indicating higher brand loyalty among eco‑conscious consumers.

- Purchase Intent Surveys: 68 % of respondents in the 18‑34 cohort indicated that they would be willing to pay a premium for products that align with their values, such as ethical sourcing or carbon neutrality.

4. Qualitative Insights into Lifestyle Trends

- Experience over Ownership: Millennials and Gen Z continue to favor spending on travel, concerts, and unique experiences over the acquisition of physical goods, leading to a rise in experiential marketing campaigns.

- Health‑First Mindset: The wellness boom is not limited to physical health; mental health products—mindfulness apps, sleep aids, and therapy services—are experiencing exponential growth.

- Digital Nomadism: The increase in remote work has created demand for tech‑enabled portable living solutions, influencing both furniture and technology product design.

- Community‑Driven Consumption: Consumers are increasingly seeking brands that foster a sense of community, whether through loyalty programs, co‑creation platforms, or social activism partnerships.

5. Implications for Stakeholders

- Investors: Companies that align their product development with sustainability and digital innovation are positioned to capture the growing consumer segments, potentially delivering higher returns.

- Retailers: Adapting to omnichannel demands and integrating AI personalization can mitigate the decline in physical foot traffic and enhance customer retention.

- Marketers: Crafting authentic narratives around ethics and community involvement can strengthen brand equity among younger demographics.

Conclusion

While MTU Aero Engines AG’s recent voting‑rights announcement signals stability in its core aerospace operations, the broader corporate landscape in consumer discretionary sectors is shaped by shifting demographics, economic headwinds, and evolving cultural values. Brands that proactively embed sustainability, leverage digital personalization, and prioritize experiential engagement are likely to outperform as consumer preferences continue to evolve toward value‑driven, ethically aligned, and technology‑enabled consumption.