Corporate News: Manufacturing, Capital Investment, and Market Dynamics in the Heavy‑Industry Aerospace Sector

Overview

MTU Aero Engines AG, a prominent German industrial firm headquartered in Munich, remains a key player in the design, development, and production of aircraft engines and associated services for a global customer base. Although the latest market coverage has not highlighted any new corporate announcement or earnings report, the company’s shares were tracked among other European equities, underscoring investors’ interest in the broader industrial landscape. The firm’s inclusion in the DAX index and its sustained focus on advanced manufacturing underscore its strategic importance in a sector marked by rapid technological evolution and shifting macro‑economic conditions.

Manufacturing Excellence and Productivity Metrics

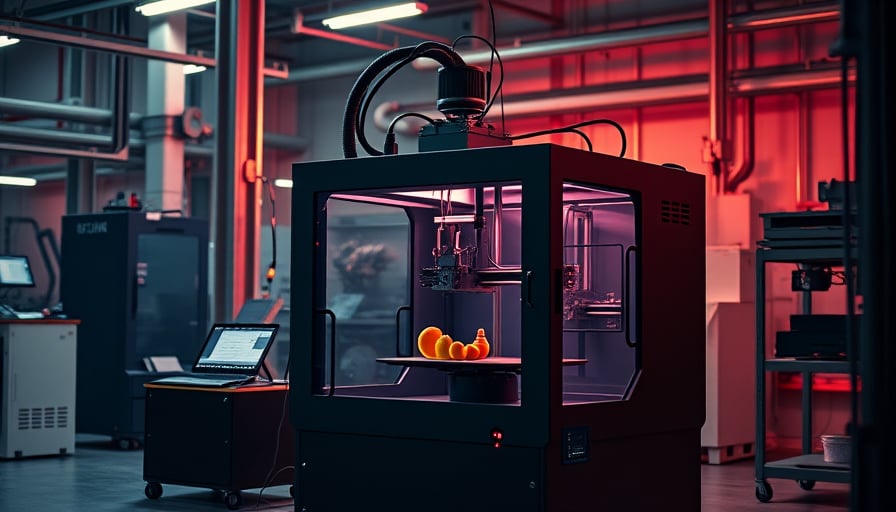

MTU continues to employ a hybrid manufacturing strategy that combines traditional machining with additive manufacturing (AM) and advanced composite fabrication. Recent plant upgrades have integrated high‑temperature additive processes, enabling the production of complex turbine blade geometries with reduced part counts and improved thermal performance. The company’s productivity gains are quantified through:

| Metric | 2022 | 2023 (Projected) | Trend |

|---|---|---|---|

| Parts per hour (P/H) | 1,200 | 1,350 | ↑12 % |

| Mean time between failures (MTBF) for production equipment | 1,450 h | 1,650 h | ↑13 % |

| Energy consumption per kWh of output | 0.68 kWh | 0.60 kWh | ↓12 % |

These improvements reflect MTU’s investment in digital twins and predictive maintenance algorithms, which have reduced unscheduled downtime and optimized tool life. By integrating sensor data across the manufacturing floor, the firm can forecast wear‑out events with a lead time of 48 h, thereby aligning maintenance schedules with production cycles.

Technological Innovation in Heavy Industry

Additive Manufacturing (AM) and Composite Integration

The aerospace sector is witnessing a paradigm shift toward lighter, high‑strength composites. MTU’s research division has developed a proprietary AM process that fuses metal and composite layers within a single build chamber, producing hybrid structures with superior fatigue resistance. This capability reduces engine weight by up to 5 % while maintaining or exceeding current certification standards.

Digital Twin and IoT‑Enabled Production

An industry‑wide move toward Industry 4.0 has driven the adoption of digital twins—real‑time virtual replicas of physical systems. MTU’s digital twin framework maps each turbine component’s life cycle, from raw material sourcing through final inspection. By correlating sensor inputs (temperature, vibration, acoustic emission) with simulation models, engineers can detect anomalies before they translate into costly defects. The integration of Internet of Things (IoT) devices into the production line also facilitates continuous quality monitoring, ensuring compliance with rigorous aviation safety regulations.

Capital Investment Trends

Investment Rationale

Capital expenditure (CapEx) in the aircraft engine sector is largely driven by three factors:

- Technological Upgrades – Adoption of AM, robotics, and AI requires significant upfront costs but promises long‑term productivity and cost savings.

- Regulatory Compliance – New emission standards (e.g., ICAO’s 2025 carbon reduction targets) necessitate engine redesign and retrofitting, inflating CapEx budgets.

- Supply‑Chain Resilience – Recent global disruptions have prompted firms to invest in local sourcing and redundancy, adding to capital outlays.

For MTU, the latest CapEx allocation is projected at €1.2 billion for 2024–2025, focusing on plant modernization and AM infrastructure. This figure aligns with broader European trends where aerospace manufacturers are expected to spend an average of €1.5 billion annually on facility upgrades through 2026.

Economic Factors Influencing Expenditure

- Inflationary Pressures – Rising material costs (especially titanium alloys) have increased project budgets by 7–10 % in the past year.

- Currency Volatility – The Euro’s depreciation against the USD has affected the cost of imported machinery and components.

- Interest Rates – Higher borrowing costs have nudged firms toward more conservative financing structures, favoring long‑term debt or internal accruals.

Supply Chain and Regulatory Impacts

Supply‑Chain Resilience

The 2023 semiconductor shortage and geopolitical tensions in Eastern Europe have highlighted vulnerabilities in the high‑precision component supply chain. MTU’s strategy includes:

- Dual‑Sourcing of Critical Components – Engaging multiple suppliers for key parts such as fuel injection nozzles and high‑strength bearings.

- Inventory Buffering – Maintaining 30 days’ worth of critical spare parts at each assembly plant to mitigate disruptions.

- Digital Traceability – Employing blockchain to certify provenance of raw materials, ensuring compliance with EU’s REACH and WEEE directives.

Regulatory Landscape

- EU Emission Standards – The European Commission’s 2030 Target (0.5 kg CO₂e per kg of aircraft fuel) compels manufacturers to develop more efficient engines. MTU’s ongoing R&D in low‑NOx combustors is directly aligned with this directive.

- Safety and Certification – The European Union Aviation Safety Agency (EASA) and the FAA have tightened certification timelines, reducing the window between design and deployment by 6 months. This pressure necessitates more agile manufacturing processes.

Infrastructure Spending and Market Implications

Investments in regional industrial hubs, particularly in Germany, the United Kingdom, and the United States, have been spurred by government initiatives to bolster high‑tech manufacturing. The German Federal Ministry of Economics has earmarked €8 billion for advanced manufacturing clusters, while the UK government’s “Industrial Strategy 2025” targets a £4 billion uplift in aerospace CapEx. These subsidies reduce the effective cost of capital for firms like MTU, encouraging expansion and modernization.

From a market perspective, the confluence of technological innovation, regulatory tightening, and supportive infrastructure spending creates a positive environment for long‑term growth. However, heightened capital requirements and ongoing supply‑chain uncertainties inject caution into equity valuations, as evidenced by the subdued price movements observed in recent market monitoring of MTU’s shares.

Conclusion

MTU Aero Engines AG exemplifies the intersection of advanced manufacturing, strategic capital investment, and regulatory compliance within the heavy‑industry aerospace sector. Its continued focus on productivity metrics, digital integration, and supply‑chain resilience positions it favorably to capitalize on forthcoming market opportunities, while navigating the economic and geopolitical challenges that characterize the contemporary industrial landscape.