Corporate News

Monolithic Power Systems Inc. has recently attracted heightened attention from institutional investors and equity analysts. The company’s shares were added to the portfolios of several investment funds, with a mix of purchases and sales indicating active trading activity. A large capital‑growth fund increased its holding by 1,476 shares, while a science‑and‑technology fund reduced its position by 180 shares. A separate brokerage firm also reported selling 656 shares.

Analyst Outlook

Analysts have maintained a bullish stance on the stock. Wells Fargo has raised its price target to a higher level, citing an overweight rating, and a separate research report from a prominent brokerage reiterated the buy recommendation with a similar target price. The consensus suggests that the market expects continued growth in Monolithic Power’s semiconductor power‑solutions business, which serves a global customer base across a range of electronic devices.

Corporate Developments

Monolithic Power announced a dividend increase for the upcoming quarter, moving the quarterly payment from $1.56 to $2.00 per share. The announcement also noted the planned retirement of long‑serving chief financial officer Bernie Blegen, with a succession plan underway. Earlier in the month, the company reported a robust fourth‑quarter performance and projected revenue for the first quarter of 2026 to be in the range of $770 to $790 million, reflecting healthy sales momentum.

Overall, the combination of analyst support, active fund trading, and positive earnings guidance suggests that the market remains cautiously optimistic about Monolithic Power Systems’ near‑term prospects.

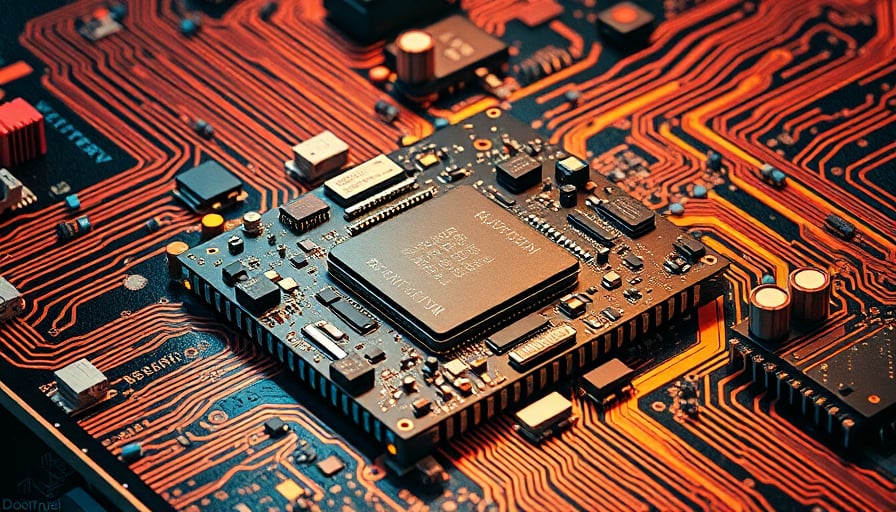

Semiconductor Technology Trends and Industry Dynamics

Node Progression and Yield Optimization

The semiconductor industry has continued its relentless push toward smaller process nodes, driven by Moore’s Law and the demand for higher performance per watt. In the current generation, 3 nm and 2.5 nm nodes are being deployed by leading fabs for high‑density logic and power devices. For Monolithic Power Systems, which specializes in power‑management ICs, the transition to sub‑10 nm nodes offers several benefits:

- Reduced Capacitance and Parasitics: Smaller nodes lower gate‑oxide thicknesses, enabling lower operating voltages and reduced switching power.

- Higher Integration Density: Power‑management solutions can incorporate more peripheral functions (e.g., multi‑phase PWM, integrated sensors) on a single die, shrinking board space.

- Improved Yield: Advanced lithography (EUV) and defect‑control processes have raised yields at deep‑submicron nodes. Yield optimization now hinges on predictive modeling of defect clusters and stochastic lithography variations, allowing fabs to fine‑tune process windows and minimize scrap.

Yield improvement strategies also involve advanced packaging techniques such as 2.5 D interposers and heterogeneous integration, which decouple the die‑level process from the system‑level interconnect, enabling higher overall yields without compromising performance.

Manufacturing Processes and Capital Equipment Cycles

Equipment Modernization

The capital equipment cycle in semiconductor fabs is characterized by a 5‑to‑7‑year cycle of major tool upgrades, particularly in EUV lithography, high‑throughput deposition, and advanced metrology. Foundries that adopt the latest EUV tools (e.g., 13.5 nm source wavelength) can push to 3 nm nodes, whereas those still relying on 193 nm immersion lithography are constrained to 7 nm and larger. For a foundry that services power‑management ICs, maintaining a mix of 300 mm and 200 mm fabs with state‑of‑the‑art lithography allows flexibility to meet diverse customer needs.

Capacity Utilization

Capacity utilization rates have historically fluctuated with cyclical demand. During the current semiconductor boom, many fabs reported utilization above 75 %, prompting an expansion of wafer throughput and the installation of additional steppers. However, the market is entering a phase of capacity creep, where fabs maintain high utilization but experience diminishing returns due to aging equipment and supply‑chain bottlenecks in critical tool components (e.g., photoresist, EUV source lifetimes). Effective capital budgeting must balance the need for capacity expansion against the risk of obsolescence and the high fixed costs of advanced lithography tools.

Design Complexity versus Manufacturing Capabilities

The design complexity of modern ICs—particularly power‑management solutions—has outpaced manufacturing capabilities in several ways:

- Fine‑pitch Interconnects: Power ICs now feature multi‑phase buck converters with thousands of MOSFETs and high‑speed I/O, requiring sub‑50 nm interconnects and low‑resistance vias.

- Thermal Management: Advanced designs integrate on‑die temperature sensors and dynamic thermal management (DTM) logic, which demand precise thermal simulations and high‑resolution thermal metrology during manufacturing.

- Reliability Requirements: Power ICs used in automotive and industrial settings must meet stringent reliability standards (e.g., JESD22-B101), pushing manufacturers to adopt more robust defect‑avoidance techniques and rigorous stress‑testing protocols.

Manufacturing facilities that can provide high‑throughput, low‑defect processes, coupled with precision thermal control, are essential to meet these demands. Foundries that invest in process‑by‑design frameworks—where designers receive real‑time feedback on process limitations—can reduce time‑to‑market and improve yield.

Semiconductor Innovations Enabling Broader Technology Advances

The continuous advancement in semiconductor technology is a catalyst for several broader technology domains:

- Artificial Intelligence (AI) and Machine Learning: Power‑efficient AI accelerators require dense, low‑voltage power ICs. Smaller nodes and improved power‑management enable higher compute density per watt, critical for edge AI deployments.

- Internet of Things (IoT): Ultra‑low‑power devices depend on sophisticated power‑management solutions to extend battery life. Innovations in charge‑pump efficiency and low‑current standby modes are directly tied to progress in process nodes.

- Automotive Electronics: Next‑generation vehicles rely on complex power‑distribution networks. Advanced power ICs with integrated protection, high‑speed control, and thermal monitoring are made feasible by high‑yield, fine‑pitch fabrication processes.

- 5G and Beyond: Power amplifiers and RF front‑ends require precise voltage regulation and thermal stability. Smaller process nodes allow tighter control over leakage currents and improved RF performance.

By pushing the boundaries of node progression, yield optimization, and manufacturing capability, semiconductor companies like Monolithic Power Systems create a virtuous cycle: better power‑management ICs unlock new application markets, which in turn drive demand for higher‑performance, lower‑power semiconductor solutions. This dynamic reinforces the importance of continuous capital investment, process innovation, and strategic partnerships between design studios and fabs to sustain long‑term growth.