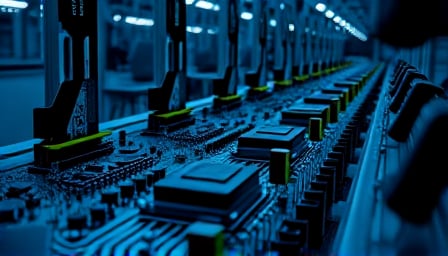

Microchip Technology Inc Faces Stock Price Decline Amid Tepid Outlook

Microchip Technology Inc, a semiconductor powerhouse, has seen its stock price take a hit following a less-than-expected outlook, despite beating second-quarter estimates. The company’s shares have plummeted 5%, leaving investors wondering if the chipmaker’s growth story is losing steam.

The decline has some investors labeling the stock as oversold, with technical analysis suggesting that the stock’s price may be due for a rebound. As the old adage goes, “be fearful when others are greedy,” and it seems that some investors are taking this advice to heart. But what’s behind the stock’s price drop, and is it a buying opportunity for savvy investors?

According to Microchip’s management, the company’s growth can be attributed to a combination of factors, including inventory optimization and a triple effect of increased sales from distributors, direct customers, and reduced inventory. However, the stock’s price development has been impacted by broader market trends, with the NASDAQ 100 and S&P 500 showing mixed performance.

- Key statistics:

- Stock price decline: 5%

- Q2 estimates beat: Yes

- Inventory optimization: Contributed to growth

- Sales increase: From distributors, direct customers, and reduced inventory

- Market trends: NASDAQ 100 and S&P 500 showing mixed performance

As investors navigate the complex world of semiconductor stocks, it’s essential to keep a close eye on market trends and company performance. Will Microchip Technology Inc be able to bounce back from its current slump, or is this a sign of a larger issue? Only time will tell, but one thing is certain: the semiconductor industry is always on the move, and investors need to stay ahead of the curve to succeed.