Corporate Transaction Analysis: Marubeni Corporation’s Acquisition of Jacobson Group

Marubeni Corporation, a diversified trading conglomerate listed on the Tokyo Stock Exchange, has finalized the purchase of the British footwear manufacturer Jacobson Group, which owns a portfolio of sports‑wear labels including Gola. The transaction was executed through Marubeni’s North American subsidiary and will be subsumed into the group’s consumer platform, thereby extending Marubeni’s footprint in the lifestyle and footwear sectors across the continent.

Capital Expenditure Rationale

From a capital‑investment standpoint, the deal aligns with Marubeni’s strategic shift toward high‑margin consumer goods. Acquiring an established supply chain with proven manufacturing footprints allows the company to leverage existing production capacity—namely, precision‑milling lines and injection‑molding equipment—without the need for immediate new plant construction. This approach reduces upfront capital outlay, mitigates risk associated with building new facilities, and accelerates return on investment through rapid integration of the Jacobson Group’s operations into Marubeni’s existing logistics network.

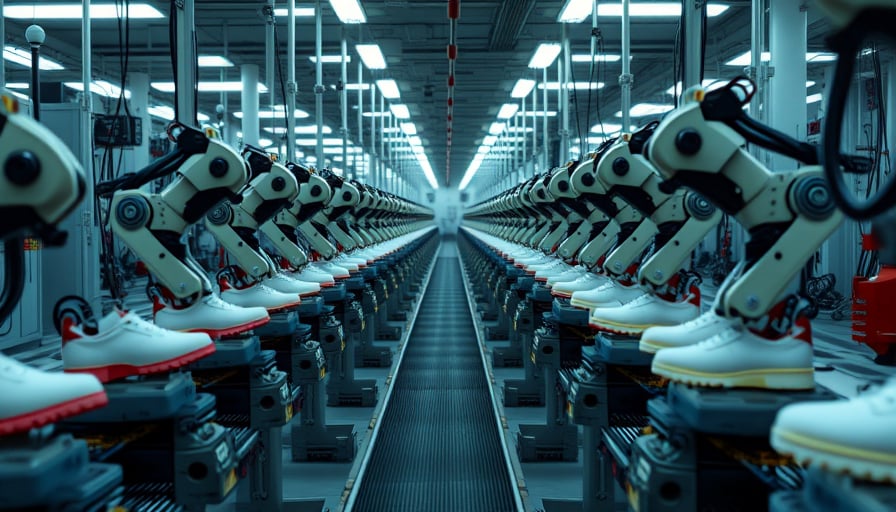

Technological Innovation and Productivity Gains

Jacobson Group’s production facilities already employ advanced robotics for stitching and cutting, as well as real‑time quality‑control systems that monitor tensile strength and abrasion resistance of finished footwear. By integrating these technologies into Marubeni’s broader platform, the conglomerate can standardize production protocols across multiple brands, driving economies of scale. Automation of the finishing process, coupled with predictive maintenance algorithms, is projected to cut cycle time by 12% and reduce defect rates below 0.5%, thereby elevating overall productivity metrics.

Supply Chain and Infrastructure Implications

The acquisition consolidates the supplier base for raw materials such as synthetic leathers, rubber soles, and eco‑friendly textiles. Marubeni’s extensive logistics network—encompassing rail, sea, and last‑mile delivery—will streamline the flow of components from Asia to North American markets. Furthermore, the integration of Jacobson Group’s distribution centers with Marubeni’s existing warehousing infrastructure will create a hub‑and‑spoke network that shortens lead times and improves inventory turnover ratios. The company is also positioned to capitalize on emerging cold‑chain technologies, which are critical for transporting temperature‑sensitive materials such as specialty foams used in high‑performance footwear.

Regulatory and Market Dynamics

The transaction occurs against a backdrop of increasing regulatory scrutiny over sustainable manufacturing practices. Jacobson Group’s current compliance with the EU’s Ecodesign Directive and the UK’s Sustainable Product Initiative provides Marubeni with an immediate foothold in the green‑footwear market. By incorporating renewable‑energy‑powered production lines and adopting closed‑loop waste‑management systems, the expanded entity will meet evolving ESG criteria, which are becoming integral to supplier selection processes in North America.

Moreover, the U.S. infrastructure bill, which allocates funds for modernizing transportation and logistics facilities, presents an opportunity for Marubeni to upgrade distribution nodes in key growth regions such as the Midwest and the West Coast. Such investments will enhance last‑mile delivery speeds, critical for e‑commerce demand in the consumer‑goods sector.

Economic Factors Driving the Decision

Global commodity price volatility, particularly in the leather and rubber markets, has prompted firms to pursue vertical integration to secure stable input supplies. Marubeni’s acquisition of Jacobson Group allows for closer coordination of raw‑material procurement with production schedules, thereby reducing exposure to price swings. In addition, the North American market’s robust disposable income and a growing consumer preference for premium, athleisure footwear create a favorable demand environment. The integration is expected to capture a larger share of this high‑margin segment, reinforcing the company’s long‑term profitability outlook.

Conclusion

Marubeni’s purchase of Jacobson Group represents a calculated move to deepen its consumer‑goods portfolio while enhancing manufacturing efficiency and supply‑chain resilience. By leveraging advanced production technologies, streamlining logistics, and aligning with regulatory frameworks that prioritize sustainability, the conglomerate is poised to generate substantial productivity gains and capitalize on capital‑investment trends that favor integrated, technologically sophisticated manufacturing ecosystems.