Knorr-Bremse AG: A Company on the Right Track, Despite Market Volatility

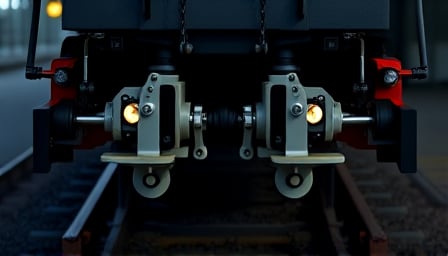

In a move that’s sure to send shockwaves through the industry, Knorr-Bremse AG has been awarded a lucrative contract to supply braking systems for Metro Rome’s subway trains from Hitachi Rail. This high-profile win is a testament to the company’s continued dominance in its field, and a clear indication that it’s still a force to be reckoned with.

But don’t be fooled – the company’s success hasn’t gone unnoticed by the market. Analysts have been warning investors to sell their shares in Knorr-Bremse, citing broader market fluctuations as a reason to be cautious. And while the company’s stock price has shown remarkable resilience, reaching an all-time high on the DAX index, it’s clear that the market is sending mixed signals.

So, what does this mean for investors? Is Knorr-Bremse AG still a promising investment opportunity, or is it time to get out while the getting’s good? The answer lies in the company’s recent performance, and the industry trends that are driving its success.

A Look at the Numbers

- The company’s recent contract win with Hitachi Rail is a significant coup, and demonstrates its ability to deliver high-quality products and services to major clients.

- Despite market volatility, the company’s stock price has shown remarkable resilience, reaching an all-time high on the DAX index.

- Analysts have recommended selling certain stocks, including Knorr-Bremse, as a precautionary measure – but is this advice based on sound reasoning, or is it simply a case of market panic?

The Bottom Line

In a market where uncertainty is the only constant, it’s more important than ever to make informed investment decisions. Knorr-Bremse AG’s recent contract win and strong performance in the industry suggest that it remains a promising investment opportunity – but only if you’re willing to take a calculated risk. Will you be one of the brave investors who takes a chance on this industry leader, or will you play it safe and sell your shares? The choice is yours.