Corporate News Analysis: Jefferies Upgrades FANUC Amid Strong Market Momentum

On December 26 2025, research analysts at Jefferies raised their price target for FANUC Corporation after the Japanese robot‑maker reported new orders in its machine‑tool segment. The upgrade came in the context of a broader rally in Japan’s market on Christmas Eve, when the Nikkei 225 index posted a modest gain and several technology names—including FANUC—posted gains. This development highlights FANUC’s positive reception by investors and the sustained momentum within the machine‑tool and industrial‑automation sectors.

Market Context and Drivers

| Market Indicator | Detail |

|---|---|

| Nikkei 225 | Modest rise on Christmas Eve, reflecting a cautious yet optimistic investor mood |

| Technology Segment | Notable gains across firms with strong exposure to automation, robotics, and AI |

| Government Policy | Fiscal initiatives aimed at boosting manufacturing productivity and investment in research and development |

| Economic Trend | Shift toward “physical artificial intelligence”—the integration of AI algorithms into physical robotic and machine‑tool systems |

The Japanese market’s resilience ahead of 2026 is largely attributable to the government’s commitment to fiscal stimulus aimed at modernizing manufacturing infrastructure. Companies that can demonstrate tangible gains in productivity and cost‑efficiency, such as FANUC, are positioned to benefit from this policy environment.

FANUC’s Business Fundamentals

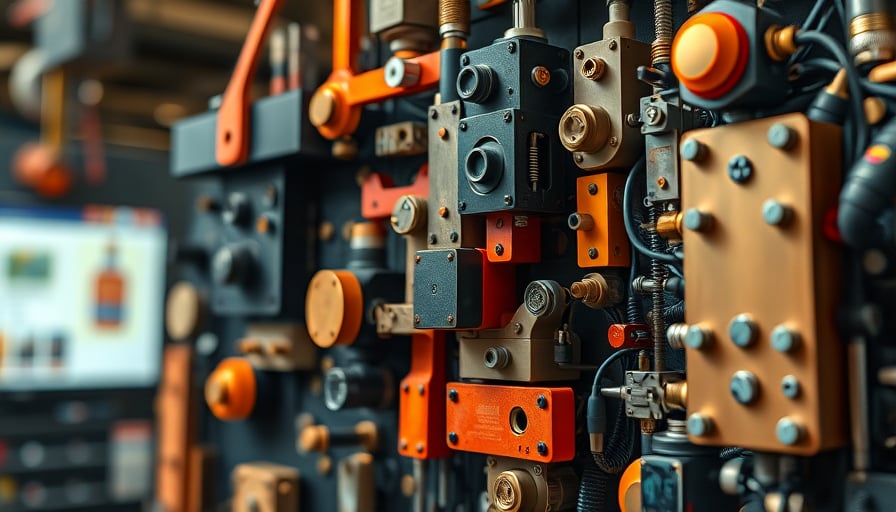

FANUC’s core competencies lie in factory‑automation systems and industrial robots. The company’s revenue streams are diversified across:

- Robot Sales – High‑precision robots for automotive, electronics, and logistics sectors.

- Machine‑Tool Sales – CNC machines and additive‑manufacturing equipment.

- Software and Services – Digital solutions for plant optimization and predictive maintenance.

The new orders reported in the machine‑tool segment reinforce FANUC’s ability to capitalize on the demand for advanced manufacturing solutions. Moreover, the firm’s robust balance sheet, strong cash‑flow generation, and consistent reinvestment in R&D underpin its competitive positioning.

Competitive Landscape

FANUC competes with a mix of domestic and global players:

| Competitor | Core Strengths | Market Share |

|---|---|---|

| Kawasaki Heavy Industries | Wide product portfolio, strong automotive ties | ~20% |

| Mitsubishi Heavy Industries | Advanced robotics, significant R&D spend | ~15% |

| Siemens AG | Global reach, integrated digital ecosystem | ~12% |

| ABB Ltd. | Strong presence in electrification and process automation | ~10% |

FANUC maintains a leading share in the Japanese domestic market and is expanding its footprint in Asia-Pacific and North America. Its focus on “physical AI” differentiates it from competitors that rely more heavily on cloud‑based solutions.

Economic Implications and Sectoral Interconnections

The performance of FANUC reflects several macroeconomic factors that transcend individual sectors:

- Supply Chain Resilience – As manufacturers seek to mitigate disruptions, automation and robotics become essential to maintain throughput.

- Labor Market Dynamics – Aging populations in advanced economies increase the demand for labor‑saving technologies.

- Technological Convergence – The blending of AI and physical machinery (the “physical AI” trend) creates new revenue streams and operational efficiencies.

These dynamics are observable not only in manufacturing but also in logistics, healthcare, and consumer electronics. Thus, FANUC’s success serves as a barometer for broader industrial transformation.

Analyst Outlook

Jefferies’ upgrade signals confidence in FANUC’s ability to sustain revenue growth and margin expansion. The firm’s inclusion among the stronger performers in Japan’s market movements underscores investor sentiment that the company will continue to reap benefits from:

- Government stimulus aimed at modernizing infrastructure.

- Continued adoption of AI in physical manufacturing environments.

- Robust demand for advanced machine tools in high‑value sectors.

In summary, FANUC’s positive reception in the market and its alignment with macro‑economic trends position it well for continued growth. The company’s strategic focus on industrial robotics and machine tools, combined with a favorable policy environment, underpins Jefferies’ optimism and reflects a broader industry shift toward intelligent automation.