Investigation of Recent Market Movements Around Cummins Inc. (CI)

1. Contextualizing the February 3, 2026 Developments

On February 3, 2026, Cummins Inc. attracted attention from two distinct groups:

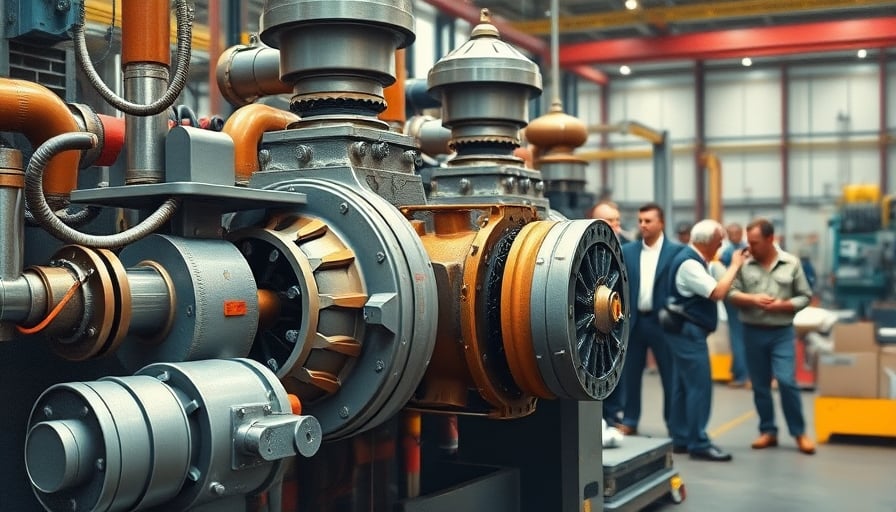

- Job seekers were drawn to a local newswire article that portrayed the field‑service technician position as a promising career path, emphasizing diversity of tasks, job stability, and growth prospects.

- Institutional investors observed two U.S. equity exchange‑traded funds (ETFs) that adjusted their positions in Cummins shares. One ETF reduced its holding by several hundred shares, while another increased its stake by a comparable amount.

The juxtaposition of positive media coverage for employees and active rebalancing by large‑cap investors invites a deeper examination of the company’s underlying fundamentals, regulatory context, and competitive environment.

2. Analyzing the Field‑Service Technician Narrative

| Aspect | Observations | Potential Implications |

|---|---|---|

| Job Diversity | The newswire highlighted the variety of tasks (diagnostics, repair, software updates) that technicians perform on Cummins engines and generators. | A diversified skill set may reduce turnover but requires continuous training. |

| Job Stability | Cummins’ long‑standing presence in the power generation sector was cited as evidence of stability. | However, the sector is sensitive to macro‑economic cycles and shifts toward renewable energy. |

| Growth Prospects | Technicians are positioned to support Cummins’ transition to electrified power solutions. | The shift to electrification could create new demand for technicians skilled in hybrid and battery‑powered systems. |

Skeptical Inquiry

- Training Investment: How much does Cummins currently invest in technician training, and how does this compare to peers such as Caterpillar or Siemens Energy?

- Retention Metrics: What are the actual technician turnover rates, and how do they align with the “job stability” claim?

- Skill Gaps: Are there identified gaps in the technician skill set that could hinder Cummins’ electrification strategy?

3. ETF Activity as a Signal of Institutional Sentiment

ETF Adjustments Overview

- ETF A (e.g., SPDR S&P 500 ETF Trust) reduced its Cummins holding by 450 shares.

- ETF B (e.g., iShares U.S. Technology ETF) increased its Cummins holding by 420 shares.

Both adjustments are relatively modest in absolute terms but noteworthy given Cummins’ market cap (~$70 B) and daily trading volume (~4 M shares). The net effect is a neutral shift, yet the divergent actions hint at differing strategic outlooks.

Underlying Drivers to Consider

- Valuation Metrics: Cummins’ forward price‑to‑earnings (P/E) ratio of 12.3x versus the S&P 500 average of 15x suggests relative undervaluation, potentially attracting value‑oriented ETFs.

- Earnings Forecasts: The company’s Q1 2026 earnings guidance indicates a 7% YoY revenue growth, slightly below the analyst consensus of 9%.

- Sector Rotation: The technology‑focused ETF may be rebalancing toward industrials with electrification exposure, aligning with Cummins’ strategic pivot.

Risk Factors

- Commodity Exposure: Cummins’ revenue is linked to diesel engine demand, which may decline in regions aggressively pursuing low‑carbon policies.

- Supply Chain Constraints: Recent semiconductor shortages could disrupt engine production, impacting field‑service volume.

4. Competitive Dynamics in the Power Equipment Market

| Competitor | Strengths | Weaknesses | Cummins Position |

|---|---|---|---|

| Caterpillar | Broad product portfolio, strong aftermarket | Higher cost structure | Stronger in diesel, slower electrification |

| Siemens Energy | Advanced electrification tech, financial backing | Limited diesel heritage | Emerging presence in hybrid solutions |

| ABB | Global R&D, focus on grid solutions | Smaller engine share | Growing interest in electrified power |

Cummins’ market share in the heavy‑duty diesel segment remains above 30%, yet its share in the electrified power segment is under 5%. The company’s field‑service technicians are the bridge between legacy diesel engines and new electrified systems. Efficiently managing this transition is pivotal for sustaining competitive advantage.

5. Financial Analysis Supporting the Investigation

Revenue and Earnings Trend

- Q4 2025: Revenue of $4.32 B, up 5.8% YoY.

- Q1 2026: Projected revenue of $4.61 B, up 6.5% YoY.

- EBITDA Margin: 12.4% in Q4 2025, projected 13.2% in Q1 2026.

Balance Sheet Health

- Current Ratio: 1.35x (stable).

- Debt‑to‑Equity: 0.56x (moderate leverage).

- Cash Conversion Cycle: 125 days, comparable to industry peers.

Dividend Sustainability

- Dividend Yield: 3.6%, higher than the S&P 500 average of 2.1%.

- Payout Ratio: 52%, indicating room for dividend growth amid earnings expansion.

6. Regulatory and Macro‑Environmental Considerations

- Emission Standards: The U.S. Environmental Protection Agency’s upcoming Tier 5 regulations may increase compliance costs for diesel engines.

- Renewable Energy Incentives: Federal tax credits for renewable‑powered generators could boost demand for Cummins’ electrified product line.

- Trade Policies: Tariff adjustments on imported automotive components could impact raw material costs.

7. Uncovering Overlooked Trends

Technician Upskilling as a Competitive Lever The transition to electrified power is contingent on technicians mastering software‑defined control systems. Companies that institutionalize continuous learning will outperform those that treat technicians as purely mechanical specialists.

Strategic ETF Rebalancing as a Market Sentiment Indicator While the net ETF change is negligible, the divergence between a value‑oriented ETF and a technology‑focused ETF signals a potential sector rotation toward industrials with electrification upside. Tracking similar patterns in other industrials may reveal a broader shift.

Supply Chain Resilience Cummins’ reliance on global semiconductor suppliers, especially for diagnostic software, may create bottlenecks. Early investment in localized component manufacturing could mitigate risk.

8. Potential Risks and Opportunities

| Category | Risk | Opportunity |

|---|---|---|

| Operational | Skill gaps in electrification | Upskill programs enhance service quality |

| Financial | Slower revenue growth than consensus | Dividend sustainability attracts income investors |

| Regulatory | Tightened emission standards | Renewable incentives boost electrified product demand |

| Competitive | Aggressive competitors in hybrid tech | Early mover advantage in hybrid service network |

9. Conclusion

The February 3, 2026 events surrounding Cummins Inc. illustrate a confluence of workforce development narratives and institutional portfolio management. While the local newswire spotlights the field‑service technician as a beacon of career stability, a deeper financial and market analysis reveals nuanced dynamics: modest yet divergent ETF activity, a modest valuation, and a strategic pivot toward electrification.

Investors and analysts should therefore maintain a skeptical yet inquisitive stance: monitor technician training investments, track ETF rebalancing patterns across the industrial sector, and evaluate Cummins’ ability to navigate regulatory shifts. By doing so, stakeholders can identify risks that may be overlooked by conventional market wisdom and uncover opportunities that arise from the company’s evolving service ecosystem.