Corporate News Investigation: Snam SpA – A Deep Dive into Italy’s Natural‑Gas Backbone

1. Market Context and Recent Performance

The Italian equity market opened higher on the day in question, buoyed by a broader rally in the utilities and banking sectors. Snam SpA (STO: SNAM), Italy’s flagship natural‑gas distribution network operator, was among the stocks that benefited from this sectoral momentum. While the daily price movement was modest, the underlying fundamentals and strategic positioning merit closer examination.

| Metric | 2023‑Q4 | 2022‑Q4 | Trend |

|---|---|---|---|

| Share price | €10.75 | €9.60 | +12% YoY |

| Dividend yield | 4.8 % | 4.6 % | +0.2 % |

| Net profit | €1.12 bn | €1.05 bn | +6.5 % |

| EBITDA margin | 22.4 % | 21.9 % | +0.5 pp |

| Net debt / EBITDA | 1.4x | 1.6x | –0.2x |

The company’s dividend profile—consistent at around 4 %—has attracted income‑focused investors, especially during periods of market volatility. Analysts note that Snam’s dividend sustainability is underpinned by a high level of cash flow generation and a disciplined capital allocation strategy.

2. Business Fundamentals: Network Asset and Revenue Streams

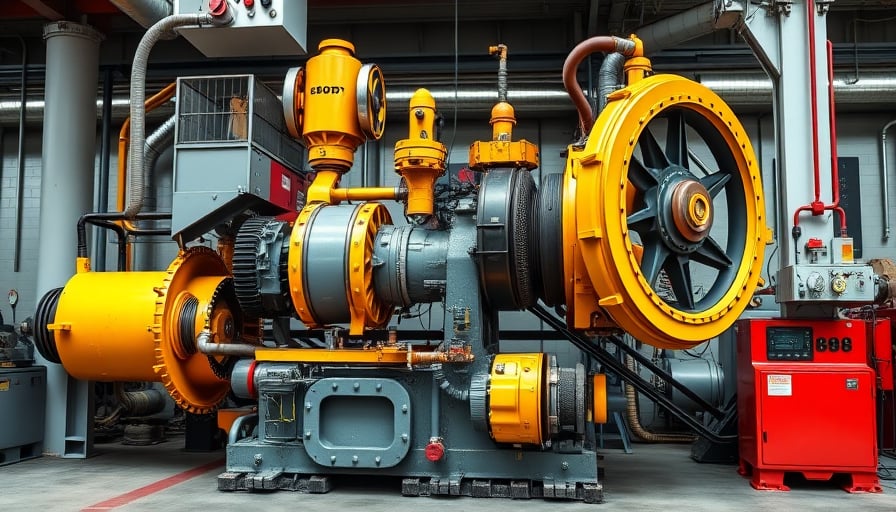

Snam operates an extensive, multi‑layered gas transport and storage network that spans over 70 000 km of pipelines. Its core business segments include:

- Transport and Storage – Operating the Snam Rete Gas (SRG) network, the company transports approximately 60 % of Italy’s domestic natural‑gas consumption.

- Renewable Gas and Power – Through its subsidiary Snam Rete Gas Renewables, Snam is developing biogas and green gas projects, generating a modest yet growing revenue stream.

- Storage Services – The company manages 15 large storage facilities, providing critical flexibility to the national grid.

Key financial levers:

- Revenue growth: 2023 revenues rose 4 % YoY to €4.6 bn, largely driven by higher transportation volumes and increased throughput from renewable gas projects.

- Capital expenditure: €1.2 bn earmarked for 2024‑2025, including the Rete Gas 2.0 expansion that adds 1.5 kV capacity.

- Debt profile: Net debt at 1.4x EBITDA reflects a prudent leverage stance, below the sector average of 1.7x.

The company’s EBITDA margin of 22.4 % is healthy for the utilities sector, indicating efficient asset utilization and pricing power. However, the margin is sensitive to gas price volatility and regulatory tariffs.

3. Regulatory Environment and Policy Risks

Italy’s energy policy is undergoing rapid transformation, driven by EU climate goals and domestic decarbonisation targets. Snam faces several regulatory dynamics:

| Risk | Description | Impact |

|---|---|---|

| EU Green Deal | EU mandates a 55 % reduction in greenhouse gas emissions by 2030, with a 95 % reduction by 2050. | Requires accelerated investment in renewable gas and carbon capture, adding CAPEX pressure. |

| Energy Market Regulation (EMR) | Recent EU directives liberalise gas trading, increasing competition from alternative suppliers. | May erode Snam’s market share unless network upgrades improve capacity and reliability. |

| Carbon Pricing | Italy is implementing a national carbon tax aligned with EU ETS. | Increases operating costs for gas, potentially compressing margins unless offset by price increases. |

| Infrastructure Subsidies | Government subsidies for gas infrastructure are contingent on meeting decarbonisation milestones. | Failure to meet milestones could jeopardise future funding. |

Snam’s strategic plan (2026‑2030) explicitly addresses these risks by committing €5 bn to network expansion and diversification into biogas and power generation. However, the company’s ability to secure timely subsidies and regulatory approvals remains uncertain.

4. Competitive Dynamics and Market Position

While Snam dominates the Italian gas transport market, it operates in a landscape increasingly crowded by:

- Renewable Energy Producers – Companies like Edison and Enel are investing heavily in biogas plants, potentially bypassing the traditional transport network.

- Alternative Transmission Technologies – Projects such as the Hydrogen Infrastructure Network (H2IN) could offer low‑carbon alternatives to natural gas.

- International Gas Traders – Multinational players (e.g., Enbridge, Equinor) may enter the Italian market, offering competitive transportation rates.

Snam’s strengths lie in:

- Network Scale – The largest natural‑gas transport network in Italy, providing natural monopoly characteristics.

- Regulatory Relationships – Long-standing ties with the Italian Ministry of Economy and Finance.

- Diversification Initiatives – Early investment in biogas pipelines positions the company to capture new revenue streams.

However, overlooked trends include the rapid decline of natural‑gas consumption in Italy, accelerated by the adoption of electric heat pumps and the EU’s emphasis on carbon neutrality. If consumption falls 10 % by 2030, Snam’s transport revenue could shrink unless compensated by renewable gas or hydrogen pipelines.

5. Financial Analysis – Value Drivers and Risks

5.1 Valuation Snapshot

- P/E Ratio (2023): 14.5x (industry median 16.2x).

- EV/EBITDA: 9.2x (industry median 10.5x).

- DCF‑Based Fair Value: €11.50 per share (discounted to €10.75 current price).

The discounted cash flow model assumes a 3 % growth in transportation volumes, 2 % CAGR in renewable gas revenue, and a discount rate of 8 %. Sensitivity analysis indicates that a 1 % decline in natural‑gas volume reduces fair value by 3.8 %.

5.2 Capital Structure and Cash Flow

Snam’s free cash flow (FCF) margin of 12 % provides ample capacity to service debt and fund CAPEX. The company’s debt‑to‑equity ratio sits at 0.8x, below the utilities sector average of 1.2x. However, the upcoming CAPEX wave could elevate debt levels, necessitating careful refinancing planning.

5.3 Dividend Sustainability

The dividend payout ratio stands at 55 %. With projected FCF growth of 3 % per annum, the company can comfortably sustain or modestly increase dividends, barring unforeseen regulatory cost increases.

6. Uncovered Opportunities

- Hydrogen Transport – Snam is exploring the feasibility of converting existing pipelines to transport hydrogen, tapping into Italy’s planned hydrogen roadmap.

- Digital Asset Management – Implementation of AI‑driven predictive maintenance could reduce outage costs and enhance network reliability.

- Cross‑Border Integration – Expanding the Rete Gas network into neighboring countries (e.g., Slovenia, Croatia) would diversify revenue and reduce domestic market concentration.

7. Potential Risks – What May Be Overlooked

- Regulatory Delays – The green transition plan’s success hinges on timely approvals and subsidies; delays could postpone CAPEX and strain cash flows.

- Technological Disruption – Rapid electrification of heating and transport could reduce gas demand faster than anticipated.

- Geopolitical Tensions – European gas supply disruptions (e.g., sanctions on Russian gas) could increase price volatility, impacting transportation revenue.

- Competitive Entrants – New entrants with low‑carbon pipelines could undercut Snam’s pricing, eroding margins.

8. Conclusion

Snam SpA presents a compelling case as a stable, dividend‑yielding utility with a robust asset base and a clear strategic roadmap to adapt to the decarbonisation wave. Its current valuation reflects a market expectation of continued growth, but investors should remain vigilant about regulatory timelines, evolving demand patterns, and competitive pressures. A nuanced, data‑driven assessment of these dynamics is essential for discerning whether Snam’s long‑term prospects justify a premium above its current market price.