Intuitive Surgical: A Closer Look at the Company’s Valuation

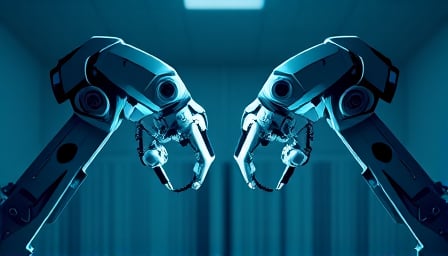

Intuitive Surgical, a pioneer in the field of robotic-assisted surgery, has been making waves in the medical technology sector. As investors and analysts closely monitor the company’s performance, a closer examination of its stock price and financial metrics reveals a complex picture.

The company’s stock price has been on a rollercoaster ride over the past 52 weeks, fluctuating between a low of $425 and a high of $616. Currently, the stock is trading at $469.81, leaving many to wonder what’s driving these fluctuations. One key metric that can provide some insight is the price-to-earnings (P/E) ratio, which stands at a staggering 65.281. This indicates that investors are willing to pay a premium for the company’s shares, suggesting a high level of confidence in its future prospects.

But what does this premium valuation mean for investors? To better understand the company’s financial position, let’s take a look at another important metric: the price-to-book (P/B) ratio. At 9.394, this ratio suggests that Intuitive Surgical is using a moderate level of leverage to finance its operations. While this may be a concern for some investors, it’s essential to consider the company’s growth prospects and its ability to generate returns on equity.

Here are some key takeaways from Intuitive Surgical’s financial metrics:

- 52-week stock price range: $425 - $616

- Current stock price: $469.81

- Price-to-earnings (P/E) ratio: 65.281

- Price-to-book (P/B) ratio: 9.394

As investors and analysts continue to monitor Intuitive Surgical’s performance, it’s essential to keep these metrics in mind. By understanding the company’s valuation and financial position, we can gain a deeper insight into its potential for growth and returns on investment.