Intel’s Stock Takes a Hit Amid Escalating Trade Tensions

Intel Corp’s stock price has been on a downward spiral in recent weeks, and the latest trade tensions between the US and China are largely to blame. As the trade war between the two economic giants continues to escalate, Intel’s shares have taken a hit, leaving investors wondering what’s next for the tech giant.

A Targeted Trade Salvo

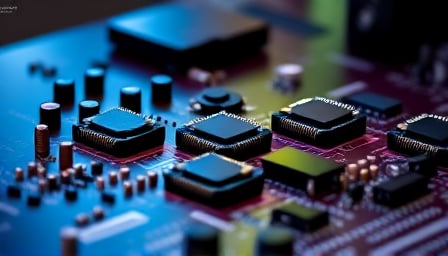

China’s latest trade measures have specifically targeted US-made chips, which has sent shockwaves through the market. Intel, a leading manufacturer of semiconductors, is among the companies that could be impacted by these new trade restrictions. The move has raised concerns about the potential impact on Intel’s operations and the broader tech industry.

Separating Fact from Fiction

While the trade tensions are certainly a cause for concern, it’s worth noting that they are not directly related to Intel’s electronic voting systems. Despite some speculation to the contrary, Intel’s voting systems are a separate and unrelated issue. The company’s focus remains on its core business of designing and manufacturing high-performance chips.

A New CEO on the Horizon

Intel’s search for a new CEO has also been making headlines, with many speculating about the potential impact on the company’s performance. The incoming CEO’s interests and leadership style will undoubtedly shape the company’s future direction, and investors are eagerly awaiting the announcement.

Market Uncertainty Lingers

In the meantime, Intel’s stock price continues to feel the effects of the ongoing trade tensions and market uncertainty. As the situation continues to unfold, one thing is clear: Intel’s stock price will likely remain volatile until the trade tensions are resolved.