Corporate Actions at Ingersoll‑Rand Inc. and Their Implications for Capital Structure and Industrial Operations

Ingersoll‑Rand Inc. (NYSE: IR) has disclosed a board‑approved proposal to convert all outstanding preferred shares into ordinary shares. While the announcement is brief and lacks specifics on timing or terms, the move carries several potential effects on the company’s capital arrangement, liquidity, and ownership distribution. The following analysis examines these implications through the lens of manufacturing operations, industrial equipment, and capital‑investment trends that influence heavy‑industry firms.

1. Capital Structure Simplification and Liquidity Impact

1.1 Preferred‑to‑Ordinary Conversion

Preferred shares in Ingersoll‑Rand carry preferential rights—often including fixed dividends and priority in liquidation—yet they remain separate from the company’s common equity. By converting the entire preferred pool into ordinary shares, the board removes a tier of capital that can complicate valuation and shareholder communications. A single, unified equity structure typically:

- Reduces administrative overhead related to dividend accounting, rights‑to‑convert mechanisms, and preferential voting procedures.

- Improves transparency for market participants, potentially narrowing bid–ask spreads and enhancing market depth for the stock.

- Facilitates future equity‑related transactions, such as rights issues or secondary offerings, by eliminating the need to account for preferred equity separately.

1.2 Liquidity Considerations

The conversion could modestly increase the share count, diluting existing equity holders but also providing a larger pool for secondary trading. If the preferred shares were previously thinly traded, the conversion may:

- Boost daily volume by making all shares equal in status, encouraging institutional investors who prefer a homogeneous equity class.

- Potentially lower volatility as the market’s perception of risk may shift from a complex, dual‑class structure to a simpler single class.

2. Ownership Distribution and Governance

All preferred shareholders will be absorbed into the ordinary shareholding base, meaning their voting rights (if any) will be subsumed under the common equity structure. This can:

- Alter the distribution of voting power among institutional and individual shareholders, possibly changing the balance between large strategic holders and smaller investors.

- Simplify governance by reducing the number of distinct classes that need to be considered in proxy materials and corporate governance disclosures.

3. Implications for Capital Expenditure and Manufacturing Operations

3.1 Capital‑Expenditure (Cap‑Ex) Planning

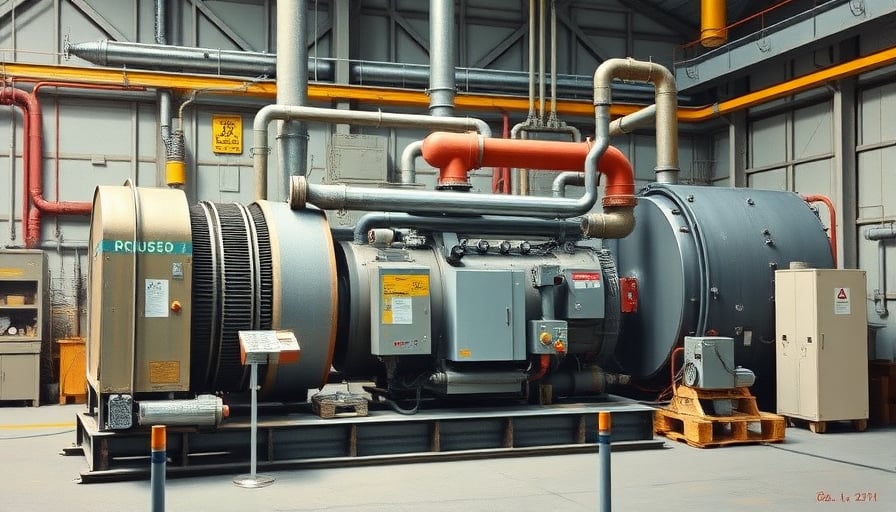

Ingersoll‑Rand’s core products—vacuum systems, bottle blowers, pumps, and compressors—are capital‑intensive and heavily reliant on advanced manufacturing equipment such as precision CNC machines, high‑speed robotic assembly lines, and energy‑efficient HVAC systems for production facilities.

- Simplified equity may improve the company’s perceived creditworthiness, potentially lowering borrowing costs for future Cap‑Ex projects. Lower interest rates can translate into savings of millions of dollars over multi‑year investment horizons.

- The ability to issue or repurchase common shares more freely could provide a flexible funding mechanism for strategic plant upgrades or acquisitions.

3.2 Productivity Metrics and Technological Innovation

Ingersoll‑Rand has historically emphasized process automation and data‑driven optimization in its manufacturing plants. Key performance indicators (KPIs) such as:

- Overall Equipment Effectiveness (OEE),

- Yield per cycle,

- Downtime per 1,000 operating hours,

are likely to be monitored closely as the company evaluates the return on its Cap‑Ex. The conversion may signal an intent to invest in:

- Digital twins of production lines for predictive maintenance,

- Additive manufacturing for rapid prototyping of pump housings,

- Energy‑efficient compressors powered by variable‑speed drives to reduce operating costs.

4. Supply Chain and Regulatory Context

4.1 Supply Chain Resilience

The global supply chain for industrial equipment has remained volatile, with disruptions stemming from semiconductor shortages, logistics bottlenecks, and geopolitical tensions. Simplifying the capital structure can provide:

- Greater agility in reallocating capital toward strategic suppliers or buffer inventories,

- Improved bargaining power by demonstrating financial flexibility to suppliers and logistics partners.

4.2 Regulatory Landscape

The U.S. and European markets impose stringent regulations on industrial equipment, particularly regarding emissions, safety, and electromagnetic compatibility. Capital investments that upgrade production facilities to comply with:

- EU’s REACH and RoHS directives,

- U.S. OSHA standards,

- International Electrotechnical Commission (IEC) standards,

are essential. The conversion of preferred shares may enhance the company’s ability to finance these compliance projects, reducing the risk of regulatory penalties that could otherwise impact earnings and cash flow.

5. Infrastructure Spending and Macro‑Economic Drivers

Broader infrastructure spending—particularly in the United States—has been projected to exceed $3 trillion over the next decade. This includes investments in:

- Transportation networks that facilitate the distribution of industrial equipment,

- Energy infrastructure that underpins manufacturing power consumption.

Ingersoll‑Rand’s alignment with infrastructure spending trends offers opportunities to:

- Secure long‑term contracts for pumps and compressors used in water treatment, gas pipelines, and renewable energy installations.

- Benefit from tax incentives (e.g., the Inflation Reduction Act’s incentives for energy‑efficient manufacturing equipment) that could lower Cap‑Ex burdens.

6. Market Implications and Investor Outlook

While the board’s proposal does not directly disclose financial terms, market participants should monitor:

- Share price reaction to the announcement, as investors may interpret the simplification as a positive signal of management intent to streamline operations.

- Future earnings guidance, particularly in the context of Cap‑Ex budgets and potential new product launches.

- Debt‑equity dynamics, given that the conversion may reduce preferred equity that previously acted as a cushion against default risk.

In sum, Ingersoll‑Rand’s decision to convert all preferred shares into ordinary shares is a strategic move that streamlines its capital structure, potentially enhances liquidity, and positions the company to pursue further investments in manufacturing technology and infrastructure‑aligned product lines. The impact on productivity metrics and capital‑expenditure decisions will likely unfold over the next fiscal periods, with the company’s ability to capitalize on regulatory compliance and supply‑chain resilience remaining critical to sustaining growth in a competitive industrial landscape.