Ingersoll Rand Inc.: Strategic Positioning Amid Rapid Air‑Oil Separator Growth

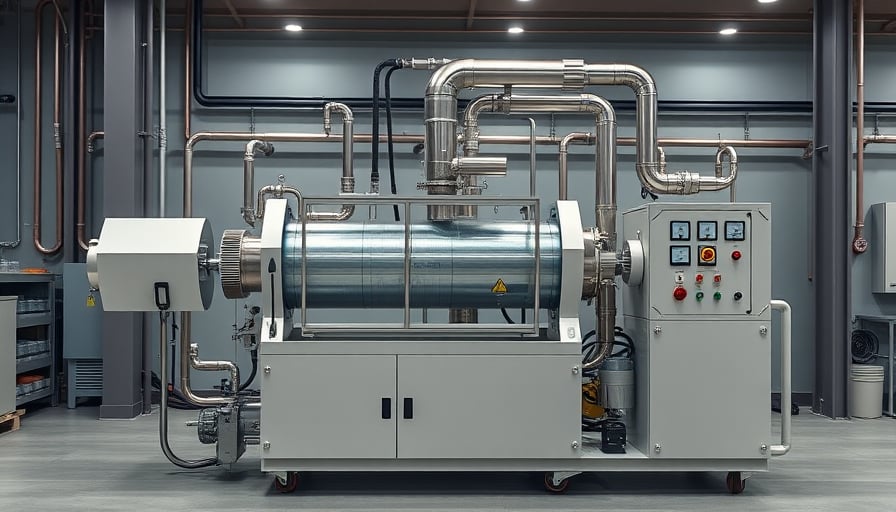

Ingersoll Rand Inc. (NYSE: IR) is a diversified industrial equipment manufacturer with a portfolio that spans vacuum systems, bottle blowers, pumps, compressors, and a growing array of flow‑control solutions. Recent market outlooks indicate that the air‑oil separator segment—critical for protecting hydraulic systems from oil contamination—will expand to a multi‑billion‑dollar valuation by 2030. North America is projected to command a significant share of this growth, positioning the company to capture substantial market upside.

Market Dynamics and Sectoral Drivers

Air‑oil separators are integral to a wide range of industrial applications, including aerospace, oil and gas, chemical processing, and heavy‑equipment manufacturing. The primary drivers for the segment’s expansion are:

- Stringent Emission Regulations – Governments worldwide are tightening requirements on particulate emissions and oil contamination. Air‑oil separators help operators meet these standards, boosting demand.

- Maintenance Cost Optimization – Separators reduce wear on hydraulic pumps, translating into lower maintenance costs and longer equipment life, a compelling value proposition for capital‑intensive industries.

- Technological Advancements – Advances in filter media and digital monitoring have improved separator efficiency and reliability, making them more attractive to operators seeking smarter, more resilient systems.

These drivers intersect across multiple sectors, illustrating how a seemingly niche product can influence broader industrial performance.

Competitive Positioning

Ingersoll Rand’s competitive advantages in the air‑oil separator market stem from several core strengths:

- Product Portfolio Breadth – The company’s existing flow‑control lineup provides cross‑sell opportunities, enabling it to bundle separators with complementary equipment such as pumps and compressors.

- Global Distribution Network – A well‑established sales and service infrastructure facilitates rapid market penetration, particularly in North America where the segment’s growth is most pronounced.

- Research and Development Capability – Ongoing R&D investment allows Ingersoll Rand to refine separator performance and integrate digital diagnostics, keeping pace with evolving industry demands.

However, the segment remains highly competitive, with key players such as Parker Hannifin, Eaton, and Johnson Controls offering comparable solutions. Ingersoll Rand must continue to differentiate through quality, after‑sales support, and technological innovation to sustain its market share.

Financial Outlook and Investor Considerations

While the company’s February 2026 earnings presentation did not disclose detailed financial performance metrics, several indicators suggest a positive trajectory:

- Capital Allocation – Recent capital expenditures have focused on expanding manufacturing capacity for high‑value flow‑control components, aligning with forecasted demand.

- Revenue Concentration – Diversification across multiple industrial sectors mitigates revenue volatility, a prudent strategy amid cyclical shifts in construction and manufacturing activity.

- Margin Discipline – Historically, Ingersoll Rand has maintained healthy gross margins in its core segments, providing a cushion to absorb potential cost pressures associated with scaling separator production.

Investors should monitor the company’s progress in ramping up separator production and its ability to secure new contracts in high‑growth regions, particularly the United States and Western Canada.

Broader Economic Implications

The projected expansion of the air‑oil separator market reflects broader trends in industrial modernization and sustainability. As capital expenditure cycles continue to favor equipment that reduces operating costs and enhances compliance, firms like Ingersoll Rand stand to benefit from a shift toward higher‑quality, longer‑lasting infrastructure. This dynamic not only supports company growth but also contributes to downstream economic benefits, such as job creation in manufacturing and improved reliability in critical industrial services.

In sum, Ingersoll Rand’s entrenched presence in industrial machinery, coupled with its strategic focus on the burgeoning air‑oil separator segment, positions the company well to capitalize on evolving market demands. Continued investment in product innovation, supply chain resilience, and customer engagement will be essential to translate these opportunities into sustained financial performance.