Infrastrutture Wireless Italiane SpA: Bridging Telecom Infrastructure and Content Delivery

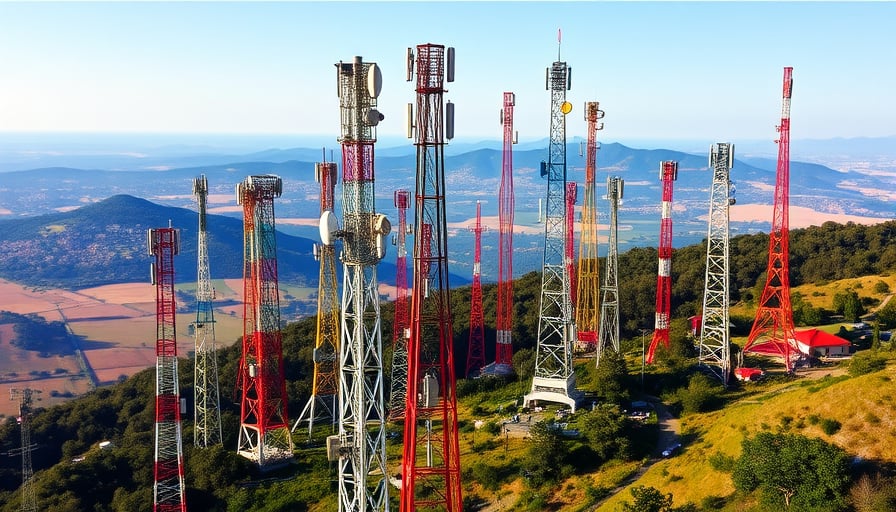

Infrastrutture Wireless Italiane SpA (IWI), headquartered in Milan, remains a pivotal player in the Italian telecommunications landscape through its extensive tower and antenna portfolio. The company’s activities—spanning site construction, maintenance, and security—support a broad spectrum of users, including radio transmission operators, broadcasting services, and public institutions. By integrating micro‑cell and distributed antenna systems (DAS) in hospitals, airports, and commercial centres, IWI enhances coverage for both voice and data services, thereby reinforcing the backbone for contemporary content delivery.

Subscriber Metrics and Network Capacity Requirements

IWI’s infrastructure underpins a subscriber base that has grown steadily as mobile penetration continues to rise. Recent data indicate that Italy’s mobile subscribers have exceeded 33 million, with an average monthly data consumption surpassing 5 GB per user. This surge places a premium on network capacity, particularly in urban hubs where peak traffic can reach several hundred gigabits per second. IWI’s focus on DAS deployment mitigates congestion by offloading traffic from macro cells, a strategy that has proven effective in maintaining service quality for high‑density venues.

Financially, IWI’s operating revenue has increased by 7.8 % YoY in the last fiscal year, driven largely by the expansion of DAS contracts. The company’s EBITDA margin—an indicator of operational efficiency—has held steady at approximately 18 %, reflecting disciplined cost management amid growing capital expenditure on tower maintenance and new site acquisition.

Content Acquisition Strategies and Competitive Dynamics

While IWI’s core competency lies in infrastructure, the broader ecosystem in which it operates is increasingly shaped by content delivery platforms. Streaming services such as Netflix, Disney+, and local Italian providers have intensified competition for bandwidth, prompting network operators to seek strategic partnerships with infrastructure owners. IWI has secured agreements with several regional telecom operators to provide dedicated backhaul for premium content services, ensuring low latency and high reliability essential for 4K and emerging 8K streaming.

The competitive dynamics in the streaming market are further complicated by the consolidation of telecom operators. In Italy, major players such as TIM, Vodafone Italy, and Iliad are actively exploring bundle offers that combine mobile data plans with subscription-based streaming services. These bundles often include preferential access to the operators’ proprietary infrastructure, thereby creating a symbiotic relationship that benefits both the content providers and the infrastructure owners. IWI’s position as a neutral infrastructure provider allows it to negotiate favorable terms with multiple stakeholders, mitigating concentration risk.

Emerging Technologies and Media Consumption Patterns

Edge computing and 5G roll‑outs are reshaping media consumption patterns by reducing latency and enabling new content formats, such as augmented reality (AR) experiences in sports events or real‑time virtual conferencing in healthcare settings. IWI’s investment in edge nodes—small data centres colocated at key tower sites—supports these use cases by bringing computing resources closer to end‑users. According to market studies, 5G‑enabled streaming adoption in Italy could grow at a compound annual growth rate (CAGR) of 12 % over the next five years.

Artificial intelligence (AI) and machine learning (ML) are also being leveraged to optimise network performance. IWI’s predictive maintenance platform uses ML algorithms to anticipate equipment failures, reducing downtime and improving subscriber satisfaction. This proactive approach is critical as consumer expectations shift towards uninterrupted streaming experiences, especially during high‑profile events such as the UEFA Champions League or the Olympic Games.

Financial Assessment and Market Positioning

From a financial standpoint, IWI’s market valuation reflects the broader confidence in the telecommunications infrastructure sector. The company’s share price has traded within a 12‑month range of €5.20 to €5.80, indicating relative stability. Its price‑to‑earnings (P/E) ratio of 14.6 positions it favourably against peers such as Telespazio (P/E 17.2) and Telecom Italia (P/E 12.8). The debt‑to‑equity (D/E) ratio of 0.65 underscores a conservative capital structure, providing resilience against cyclical downturns in the media sector.

Audience data derived from industry reports suggest that Italian households are spending an average of 18 hours per week on streaming services, up from 12 hours in 2018. This trend underscores the importance of robust infrastructure to support high‑volume content delivery. IWI’s strategic expansion plans—targeting an additional 120 tower sites over the next three years—align with the projected increase in data traffic and the growing demand for ultra‑high‑definition content.

Conclusion

Infrastrutture Wireless Italiane SpA occupies a crucial intersection between telecommunications infrastructure and content delivery. Its focus on network expansion, coupled with strategic partnerships in the streaming ecosystem, positions the company to capitalize on the evolving media consumption landscape. As emerging technologies such as 5G, edge computing, and AI-driven network optimisation mature, IWI’s role in ensuring seamless, high‑quality content delivery will become increasingly indispensable. The firm’s solid financial metrics, coupled with a stable market perception, suggest a resilient outlook amid the dynamic competitive environment of Italy’s telecom and media sectors.