Corporate News – IDEX Corp

Overview

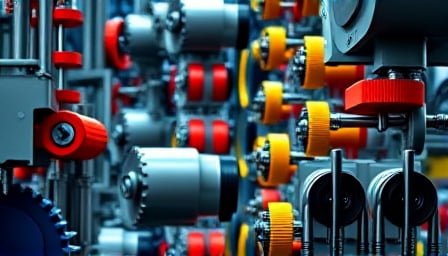

IDEX Corp continues to demonstrate consistent operational performance, underscoring its position as a niche leader in high‑quality industrial solutions. The company’s strategy focuses on precision‑driven growth within complex flow systems, which has contributed to its sustained success.

Financial Highlights

- Capital Efficiency: IDEX Corp maintains a disciplined approach to capital allocation, ensuring optimal use of resources.

- Free Cash Flow: The firm reports strong free cash flow, supporting ongoing investment and shareholder returns.

- Market Capitalization: IDEX Corp’s market capitalization remains substantial, reflecting its established presence and investor confidence.

Share Performance

- Price Stability: The stock price has remained relatively stable, with minor fluctuations observed recently.

- 52‑Week Range: While the share price has not yet reached its 52‑week high, it continues to hold a robust market position.

- Investor Sentiment: Notable investors—including Mario Gabelli, Wallace Weitz, and George Soros—have publicly included IDEX Corp in their stock selections, indicating confidence in the company’s long‑term growth potential.

Related Developments

- Indian Energy Exchange Ltd (IEE): IEE has announced a schedule of investor meetings. This event could influence perceptions of IDEX Corp, although the specific impact on the stock price remains uncertain at this time.

Conclusion

IDEX Corp’s focus on precision engineering, efficient capital use, and strong free cash flow positions it well for continued stability and growth. Investor endorsements from prominent figures reinforce the company’s reputation, while forthcoming events at related entities like Indian Energy Exchange Ltd may warrant monitoring for potential market effects.