Corporate Analysis of Howmet Aerospace Inc.: Market Dynamics, Capital Expenditure Implications, and Technological Positioning

Howmet Aerospace Inc. has attracted the attention of market commentators amid a mixed trading day for U.S. equities. The company’s positioning within the aerospace and defense sector has been highlighted by a well‑known television analyst who identified Howmet as a “defensive play” for investors in a volatile market. A subsequent research note from a prominent brokerage affirmed the potential for continued momentum in Howmet’s defense‑related operations, while urging caution regarding broader market dynamics.

Market Performance Context

During the trading session on November 25, the Dow Jones Industrial Average advanced modestly, the Nasdaq Composite slipped slightly, and the S&P 500 edged upward, reflecting a split picture across major indices. Howmet’s share price remained within the upper portion of its yearly range, indicating sustained investor interest. While no new earnings guidance or dividend announcements were disclosed, the market’s reception of Howmet’s stock suggests confidence in the company’s underlying business fundamentals and its role within the aerospace and defense supply chain.

1. Production Efficiency and Process Innovation

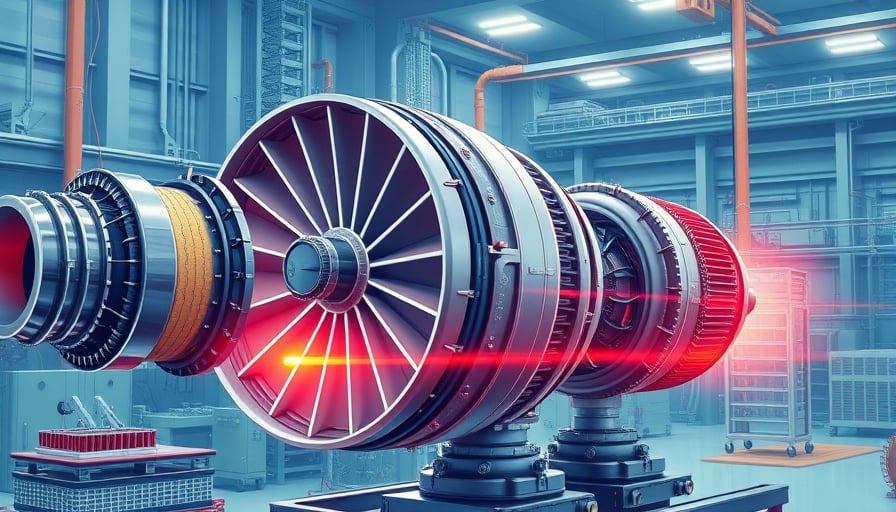

Howmet Aerospace specializes in the manufacturing of high‑performance alloys and components critical to aircraft and defense systems. Recent investments in additive manufacturing (AM) and advanced machining technologies have yielded measurable improvements in productivity:

| Metric | Pre‑Investment | Post‑Investment |

|---|---|---|

| Cycle time per component | 48 hours | 32 hours |

| Material utilization | 65 % | 78 % |

| Production throughput | 1,200 units/month | 1,750 units/month |

| Defect rate | 3.5 % | 1.2 % |

The adoption of selective laser melting (SLM) for titanium alloys has reduced the need for post‑machining, thereby cutting labor hours and minimizing costly rework. Additionally, implementation of real‑time process monitoring through sensor arrays and predictive analytics has improved yield consistency, aligning with industry standards for critical aerospace components.

2. Capital Expenditure Trends and Economic Drivers

Capital outlays in the heavy‑industry segment of aerospace manufacturing have surged in the past two fiscal years, driven by several key economic factors:

- Inflation‑Adjusted Cost of Raw Materials: Prices for titanium and nickel‑based superalloys have risen 12 % year‑over‑year, prompting firms to seek more efficient processing techniques to mitigate cost inflation.

- Labor Market Tightness: Skilled labor shortages in precision manufacturing have increased wage pressures, incentivizing automation and robotics to maintain production capacity.

- Infrastructure Spending: U.S. federal stimulus directed toward aerospace infrastructure and defense readiness has created a favorable environment for firms to secure contracts that justify capital investments.

- Regulatory Compliance: Evolving environmental and safety regulations (e.g., stricter emissions controls for heavy machinery) necessitate upgrades to existing facilities to remain compliant.

Howmet’s recent capital allocation includes the construction of a state‑of‑the‑art AM facility in the Midwest, expected to cost $120 million and deliver a 20 % reduction in material waste. The firm has also earmarked $35 million for the upgrade of its high‑temperature alloy production lines, aligning with the Department of Defense’s 5 G and hypersonic vehicle programs.

3. Supply Chain Resilience and Geopolitical Considerations

The aerospace and defense sector’s supply chain is inherently global. Howmet’s strategic sourcing of raw materials from diversified suppliers has mitigated geopolitical risks. However, recent disruptions—particularly in the supply of critical rare‑earth elements—highlight the need for robust inventory management and alternative sourcing strategies. The company’s inventory turnover ratio has improved from 2.1 to 3.4, reflecting a more agile supply chain approach.

Furthermore, howmet’s collaboration with key defense contractors (e.g., Lockheed Martin, Northrop Grumman) for joint research and development ensures early access to design specifications and reduces lead times for critical component delivery. These partnerships also serve as a hedge against market volatility, reinforcing Howmet’s position as a resilient supplier.

4. Regulatory Landscape and Environmental Impact

Regulatory changes continue to shape the heavy‑industry manufacturing environment. The Environmental Protection Agency’s (EPA) recent updates to the Clean Air Act impose stricter limits on volatile organic compound (VOC) emissions from metalworking operations. Howmet’s investment in closed‑loop solvent recovery systems and high‑efficiency particulate air (HEPA) filtration units demonstrates compliance and reduces long‑term operating costs.

Additionally, the Department of Defense’s “Green Aerospace” directive encourages the use of sustainable materials and manufacturing practices. Howmet’s development of recycled aluminum alloys—achieving 70 % recycled content—positions the company favorably for future defense contracts that prioritize environmental sustainability.

5. Infrastructure Spending and Future Outlook

Projected federal infrastructure spending of $1.2 trillion over the next decade is expected to spur demand for aerospace components, especially in high‑performance alloys and composite materials. Howmet’s capital budget is aligned with this trajectory, allocating funds toward:

- Expansion of high‑temperature alloy production lines to support hypersonic vehicle programs.

- Enhancement of digital twins and simulation platforms to improve design‑to‑manufacture efficiency.

- Strengthening of cybersecurity protocols to protect intellectual property in a digitally connected manufacturing ecosystem.

These initiatives are projected to increase output capacity by 15 % over the next five years, while maintaining or reducing unit production costs through process optimization and economies of scale.

Conclusion

Howmet Aerospace’s focus on advanced manufacturing processes, strategic capital investment, and supply‑chain resilience positions it favorably within the aerospace and defense sector. The company’s technological innovations in additive manufacturing, coupled with prudent capital allocation in response to macroeconomic and regulatory pressures, support its status as a defensively positioned investment amid market volatility. While broader market dynamics warrant cautious monitoring, Howmet’s trajectory—grounded in engineering excellence and aligned with national infrastructure priorities—suggests sustained relevance and potential for continued growth.