The TJX Companies, Inc. Demonstrates Resilience Amidst a Dynamic Retail Landscape

Market Performance and Investor Sentiment

The TJX Companies, Inc. (NYSE: TJX) continues to exhibit a robust trajectory in the equities market. Over the past several years, the company’s share price has consistently outperformed key benchmarks, including the S&P 500 and the broader consumer discretionary sector. This sustained outperformance has attracted heightened interest from institutional and retail investors alike. Analysts emphasize that the firm’s return on equity and dividend yield remain attractive relative to peers, reinforcing its standing as a staple holding within diversified portfolios.

During the current calendar year, TJX’s stock price has risen markedly, surpassing the gains recorded by the overall market indices. While the announcement does not disclose specific pricing details, the upward trend underscores confidence in the company’s operational model and market positioning.

Operational Model and Strategic Positioning

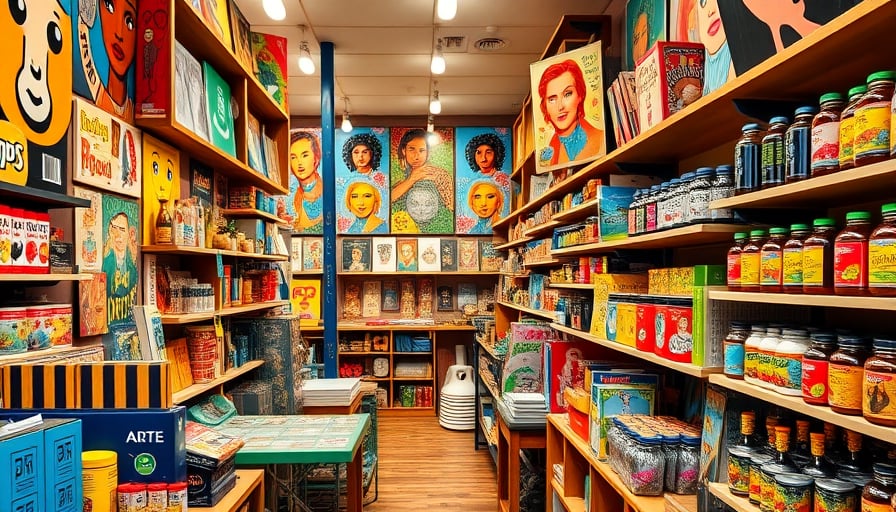

TJX’s business model centers on a unique blend of off‑price retailing and deep inventory sourcing. By acquiring excess merchandise from manufacturers and other retailers—often through liquidation and overstock sales—TJX secures inventory at discounted costs. These lower procurement prices translate into attractive price points for consumers, driving traffic and repeat purchases. The company’s store footprint spans more than 4,800 locations worldwide, with a significant presence in the United States and Canada, and an expanding international portfolio in Europe and Asia.

Key elements that contribute to TJX’s resilience include:

- Supply‑Chain Flexibility: The company’s ability to swiftly adapt to shifting inventory streams allows it to mitigate price volatility and capitalize on supply disruptions that may impact traditional retail competitors.

- Consumer-Centric Pricing: TJX’s value proposition aligns with consumer demand for high-quality goods at a fraction of the retail price, a dynamic that has proven robust even during periods of inflationary pressure.

- Digital Integration: Although primarily a brick‑and‑mortar retailer, TJX has accelerated its e‑commerce capabilities, including same‑day delivery and a comprehensive omnichannel strategy, positioning it to capture the growing segment of digitally engaged shoppers.

Sectoral and Macro‑Economic Context

The broader retail environment remains fragmented, with online giants and specialty retailers vying for market share. Nonetheless, the off‑price segment has displayed particular resilience in a high‑inflation landscape, as consumers gravitate toward value-oriented purchases. TJX’s performance reflects this macro‑economic trend, and the company’s continued success suggests that off‑price retailers can serve as a counterbalance to traditional full‑price competitors during periods of economic uncertainty.

Furthermore, TJX’s supply‑chain agility offers insights transferable to other industries. For example, manufacturing firms can adopt flexible sourcing practices to reduce inventory carrying costs and improve responsiveness. Similarly, hospitality and hospitality‑related services can examine TJX’s approach to cost control and customer experience optimization.

Competitive Landscape

Within the off‑price sector, competitors such as Ross Stores, Inc. and Burlington Stores, Inc. also maintain sizeable store networks. However, TJX consistently leads in market share, driven by its global footprint and broader assortment mix. The company’s strong balance sheet, evidenced by robust free‑cash‑flow generation, provides the financial latitude to invest in store expansion, digital initiatives, and strategic acquisitions.

Outlook

Analysts project continued growth for TJX, contingent upon the firm’s capacity to sustain its cost‑efficient sourcing model while expanding its digital footprint. In a post‑pandemic retail environment where consumer preferences continue to shift toward convenience and value, TJX’s strategic focus positions it to capture a significant share of the evolving market. The company’s track record of outperforming benchmarks and delivering shareholder returns reinforces its status as a leading player in the off‑price retail sector.