Stryker Corp. Experiences Mixed Institutional Activity Amid Strategic Shift

Institutional Trading Overview

Recent trading data indicate a nuanced activity pattern among institutional investors in Stryker Corp., a U.S.-based medical‑equipment manufacturer. Large asset‑management firms, including Goldman Sachs and BlackRock, have increased their holdings in the company, reflecting confidence in its evolving business model. Conversely, firms such as Voya, Lee Financial, and Cascade Investment have reduced their positions, signaling a selective divestment strategy. Telos Capital Management added shares, aligning with its broader focus on high‑growth technology and healthcare assets.

The aggregate effect on Stryker’s share price has been modest. The market has reacted with relative quiet, suggesting that while institutional sentiment is diversified, overall valuation has not yet experienced significant volatility.

Strategic Context: From Implant Maker to Platform Provider

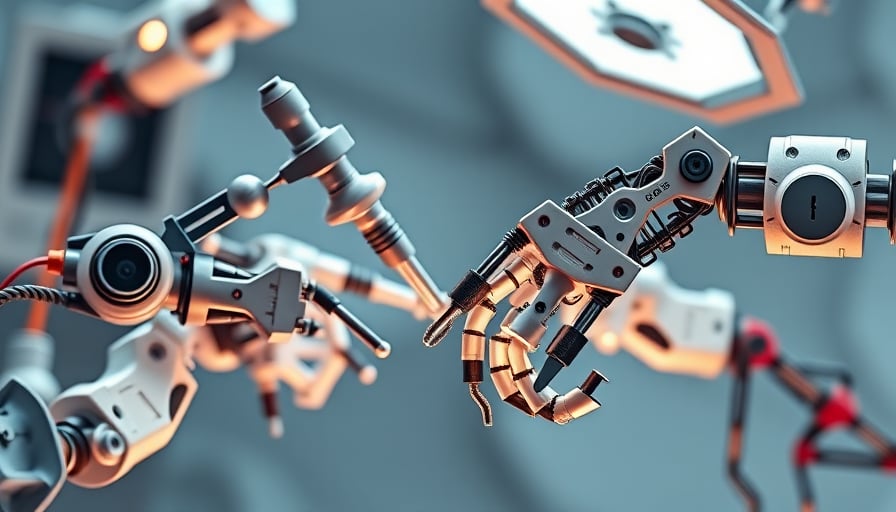

Stryker has pursued a deliberate pivot from a conventional orthopedic and implant‑focused company toward a broader platform that incorporates robotics, digital health, and advanced surgical solutions. This strategy has attracted investor attention, particularly from firms that prioritize technology integration in surgical environments.

Key initiatives include:

- Expansion of the Mako® robotic‑assisted surgery line, now available across orthopedics, spine, and general surgery.

- Development of Stryker’s digital ecosystem, encompassing real‑time data analytics for surgical outcomes.

- Strategic acquisitions of complementary technology firms to accelerate product diversification.

These moves aim to increase recurring revenue streams, improve margin profiles, and position Stryker as a comprehensive solutions provider in the surgical technology market.

Market Implications

1. Share Price Dynamics

The net institutional inflows and outflows have not yet produced a pronounced price swing. This muted reaction may be attributed to:

- Balanced portfolio adjustments: Gains from new entrants offset losses from divestitures.

- Expectation alignment: Investors anticipate that the platform shift will materialize over a multi‑year horizon, reducing immediate price impact.

- Liquidity considerations: Stryker’s high trading volume mitigates price distortion from large block trades.

2. Investor Sentiment

- Buy‑side: Asset managers emphasizing technological disruption are increasingly allocating to Stryker, perceiving a strategic advantage in the evolving surgical landscape.

- Sell‑side: Certain investors are cautious, possibly due to concerns over the capital intensity of platform development and integration risk.

3. Regulatory Landscape

Stryker’s expansion into digital health and robotics requires regulatory clearance from bodies such as the FDA. The company has:

- Received approvals for key robotic systems.

- Engaged in ongoing submissions for new indications.

- Participated in post‑market surveillance initiatives to demonstrate device safety and efficacy.

Compliance with evolving regulatory frameworks remains a critical factor influencing investor confidence.

Practical Implications for Healthcare Professionals

- Adoption of Robotic Systems: The broadened platform offers clinicians access to integrated surgical robotics and data analytics, potentially enhancing precision and postoperative outcomes.

- Training and Implementation: Hospitals must invest in staff training and infrastructure upgrades, a consideration for budgeting and reimbursement strategies.

- Clinical Outcomes Data: Stryker’s commitment to publishing real‑world evidence supports evidence‑based adoption decisions.

Conclusion

Stryker Corp.’s recent institutional trading activity reflects a cautious yet sustained interest in its strategic transition from a traditional implant maker to a diversified platform provider. While share price movements remain muted, the company’s focus on robotics, digital health, and regulatory compliance positions it well for long‑term growth within the healthcare equipment sector. Continued monitoring of institutional flows, regulatory approvals, and market performance will be essential for stakeholders evaluating Stryker’s value proposition.